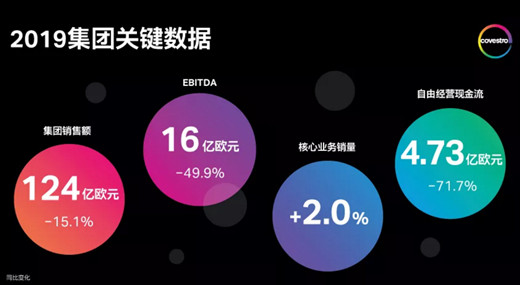

Core business sales increased by 2.0%

Group sales amounted to about 12.4 billion euros (-15.1%)

EBITDA in line with expectations, reaching around EUR 1.6 billion (-49.9%)

Proposed dividend of 2.40 euros per share

Covestro launched a global strategic project in fiscal year 2019 to implement circular economy development in various sectors. For example, the company is actively promoting the use of alternative raw materials, developing various innovative recycling technologies, and establishing extensive cooperation and new business models.

01 Efficiency ensures resilience

Given that the outlook for 2020 remains challenging, Covestro is accelerating the implementation of a long-term project aimed at increasing effectiveness and efficiency. Launched in October 2018, the project has helped the company cut costs by around 150 million euros in the last fiscal year. In 2020, the company aims to save 250 million euros through this project, and by the end of 2021, it is expected to achieve a cumulative annual saving of about 350 million euros. In addition, the company has taken various short-term measures such as more efficient cost management and a re-examination of all existing and planned investments.

02 Fully explore the commercialization potential of product innovation

At last year’s K show in Düsseldorf, Covestro presented numerous product innovations addressing global challenges such as urbanization, future mobility and climate change. In the coming years, the company will focus on realizing the full commercial potential of these innovations. Sucheta Govil, who took over as Covestro board member and chief commercial officer in the summer of 2019, will focus on enhancing Covestro’s sales force. Her goal is to continue to strengthen customer-centricity, optimize and advance the digitalization of marketing strategies, and explore attractive market opportunities more efficiently.

03 Continuous Review of Investment Projects: Focus on Long-Term Success

In 2019, Covestro invested a total of 910 million euros (2018: 707 million euros), the highest in the company’s history. In terms of investment project management, the company has always focused on efficiency and optimal use of capital. In view of the still severe market environment, Covestro announced in January 2020 that it would suspend its MDI investment project in Baytown, USA for 18 to 24 months.

Nevertheless, Covestro still firmly believes that MDI has a bright long-term growth prospect. Covestro’s new MDI production facility in Brunsbütt, Germany has started production as planned in the first quarter of 2020, thereby doubling the site’s production capacity to 400,000 tons per year. The Bloomsbütt site will thus become one of the three largest MDI production bases in Europe, consolidating Covestro’s leading position in this market.

2020 Financial Guidance

The market environment is still severe

Core business volumes achieved low-single-digit percentage growth

Free operating cash flow maintained between 0 and 400 million euros

The rate of return on capital employed will be between 2% and 7%

EBITDA will be between 1 billion and 1.5 billion euros (EBITDA in the first quarter of 2020 is expected to be between 200 million and 280 million euros)

In addition, the company is not yet able to fully estimate the financial impact of the novel coronavirus on fiscal 2020.

Annual performance of the three major business departments

Polyurethane and polycarbonate segment sales growth

Benefiting from the growth in demand from the furniture, construction, and electronics, electrical and home appliance industries, the core business sales volume of the polyurethane business segment increased by 2.3% year-on-year. Growth from these sectors was more than enough to offset weak demand in other sectors such as autos. Due to intensified competition in the market and lower average selling prices, sales in this segment fell by 21.5% to 5.779 billion euros. Despite lower raw material prices, the lower selling prices weighed heavily on profit margins. As a result, the segment’s EBITDA fell by 63.2 percent to 648 million euros.

Thanks to the strong demand in the electrical and electronic and home appliances and construction industries, the core business volume of the polycarbonate business segment increased by 2.7% year-on-year. The sales price level of this segment also declined year-on-year due to intensified market competition, resulting in a 14.3% decrease in sales to 3.473 billion euros, and a 48.3% drop in EBITDA to 536 million euros. In addition, the sale of the U.S. flat products business in the third quarter of 2018 had a negative impact of 2.2% on sales in fiscal 2019.

Core business sales in the Coatings, Adhesives and Specialty Chemicals business segment decreased by 1.0% year-on-year due to weak demand for coatings front-end raw materials in the automotive industry. Sales of this segment reached 2.369 billion euros, basically the same as in 2018. EBITDA increased by 1.1 percent to 469 million euros. Segment profit was negatively impacted by lower margins due to lower selling prices, combined with lower volumes, however, positively impacted by exchange rate factors and Covestro’s increased stake in Japan’s DIC Covestro Polymer Ltd.

Operate more efficiently,

More focus on innovation,

Invest for the longer term.

In 2019, Covestro is grateful to be seen by more people.

In 2020, Covestro looks forward to creating together with you.

微信扫一扫打赏

微信扫一扫打赏