AkzoNobel’s performance in the third quarter of 2023 continued to recover, with profits growing steadily and free cash flow strong.

Highlights of the third quarter of 2023 (compared to the third quarter of 2022)

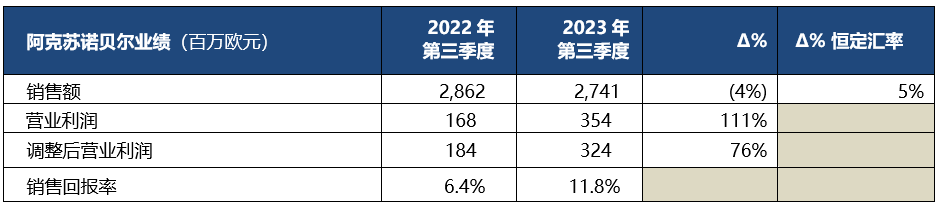

• Sales increased 5% in constant currency, driven by higher pricing, despite flat volumes; sales fell 4% after accounting for the unfavorable impact of currency

• Operating profit increased to €354 million (Q1 2022: €168 million)

• Adjusted operating profit of €324 million (compared to €184 million in the same period of 2022); return on sales of 11.8% (compared to 6.4% in the same period of 2022)

• Net cash generated from operating activities increased with inflows of €297 million (previous year 2022: €126 million)

• Net debt/EBITDA ratio continued to improve to 3.2x

AkzoNobel CEO Greg

Poux-Guillaume said: “Despite the adverse currency impact, our third quarter performance was still good, with steady profit growth and continued improvement in margins. Although sales were flat, the easing of raw material costs continued to benefit us. Benefits Thanks to rising profits and improved working capital management, our leverage ratio fell to 3.2, and we are on track to meet our annual guidance.”

2023 Outlook:

AkzoNobel expects that the current macroeconomic uncertainty will continue and put pressure on organic sales growth. In view of this, the company will focus on profit management, cost reduction, working capital normalization and deleveraging.

Cost-cutting measures are expected to alleviate to some extent the pressure caused by higher-than-expected expansion of operating expenses in 2023. AkzoNobel expects lower raw material costs to have a positive impact on the company’s profitability.

Based on current market conditions, AkzoNobel has set an adjusted profit before interest, tax, depreciation and amortization target of 1.4 to 1.55 billion euros.

We target to reduce leverage, the ratio of net debt/earnings before interest, tax, depreciation and amortization, to below 3.4x by the end of 2023, including eliminating the impact of the acquisition of Kansai Paint’s paints and coatings business in Africa, and by 2023 Later, the leverage ratio was restored to about 2 times.

微信扫一扫打赏

微信扫一扫打赏