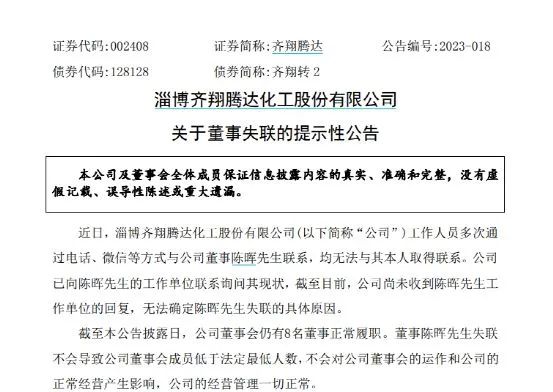

On April 12, Qixiang Tengda issued an announcement saying that recently, the staff had contacted Chen Hui, the director of the company, by telephone, WeChat, etc. many times, but they were unable to get in touch with him. The company has contacted Chen Hui’s work unit to inquire about his current situation. As of now, the company has not received a reply from Chen Hui’s work unit, and cannot determine the specific reason why Chen Hui lost contact.

According to the resume information previously disclosed by the company, Chen Hui was born in 1969, Chinese nationality, no right of abode abroad, and a master’s degree. He has successively served as a loan officer, office director, and assistant to the president of Guangzhou Tianhe Sub-branch of China Construction Bank, deputy general manager of the business department of Guangzhou Branch of Shenzhen Development Bank, and vice president of Guangdong Hengrong Financing Guarantee Company. Since April 2017, he has served as a director of Qixiang Tengda. He is currently a director of Junhua Group Co., Ltd., deputy general manager of the financial management center, and concurrently serves as a supervisor of Cedar Holdings Group Co., Ltd., a supervisor of Guangzhou Lianhua Industrial Co., Ltd., and Shenzhen Qianhai Lianshang Commercial Co., Ltd. Supervisor of Factoring Co., Ltd., etc.

Information shows: Chen Hui is also a director of Cedar Holdings. A reporter learned from people close to Cedar Holdings that Chen Hui has worked in Cedar for many years.

As early as 2016, Zhang Jin, the actual controller of Cedar Holdings, transferred 80% of the shares of Qixiang Tengda held by some shareholders of Qixiang Tengda, the controlling shareholder of Qixiang Group, through Junhua Group, a subsidiary of Cedar Holdings. The actual controller of Xiangtengda was changed from Che Chengju to Zhang Jin, and Qixiang Tengda also became part of the chemical industry sector of Cedar Holdings.

Since then, Chen Hui, director of Cedar Holdings, has been appointed as the chairman of Qixiang Group, and was nominated as a director of Qixiang Tengda in March 2017.

At present, Qixiang Tengda is in the tender offer period. The announcement shows that Shanneng New Materials tendered 1.459 billion shares of Qixiang Tengda, accounting for 51.31% of the total issued shares of Qixiang Tengda, and the tender offer price was 7.14 yuan per share. The shares involved in the tender offer are tradable shares held by all shareholders of Qixiang Tengda except Qixiang Group.

The State-owned Assets Supervision and Administration Commission of Shandong Province is the actual controller of Shanneng New Materials. This tender offer means that Shanneng New Materials, as a reorganization investor, obtained 80% of the equity of Qixiang Group through the reorganization process, and then indirectly controlled the shares held by Qixiang Group. Triggered by the 45.91% stake in the listed company.

Qixiang Tengda also said that the company’s board of directors still has 8 directors performing their duties normally. Director Chen Hui’s loss of contact will not cause the number of members of the company’s board of directors to fall below the statutory minimum, and will not affect the operation of the company’s board of directors and the normal operation of the company. The company’s operation and management are all normal.

On January 20, Qixiang Tengda released the 2022 annual performance forecast. It is estimated that the net profit attributable to shareholders of listed companies in 2022 will be about 598 million to 837 million yuan, a year-on-year decrease of 65% to 75%; ; Basic earnings per share of 0.22 yuan to 0.3 yuan. As of April 13, the current market value of the company is about 20.3 billion yuan.

微信扫一扫打赏

微信扫一扫打赏