Due to a foreign-related equity dispute, Mengbaihe, a leading software and home furnishing company, was ordered to pay US$24.7056 million to overseas distributors. This fee has since been adjusted and reduced to US$17.2741 million (approximately RMB 123 million yuan).

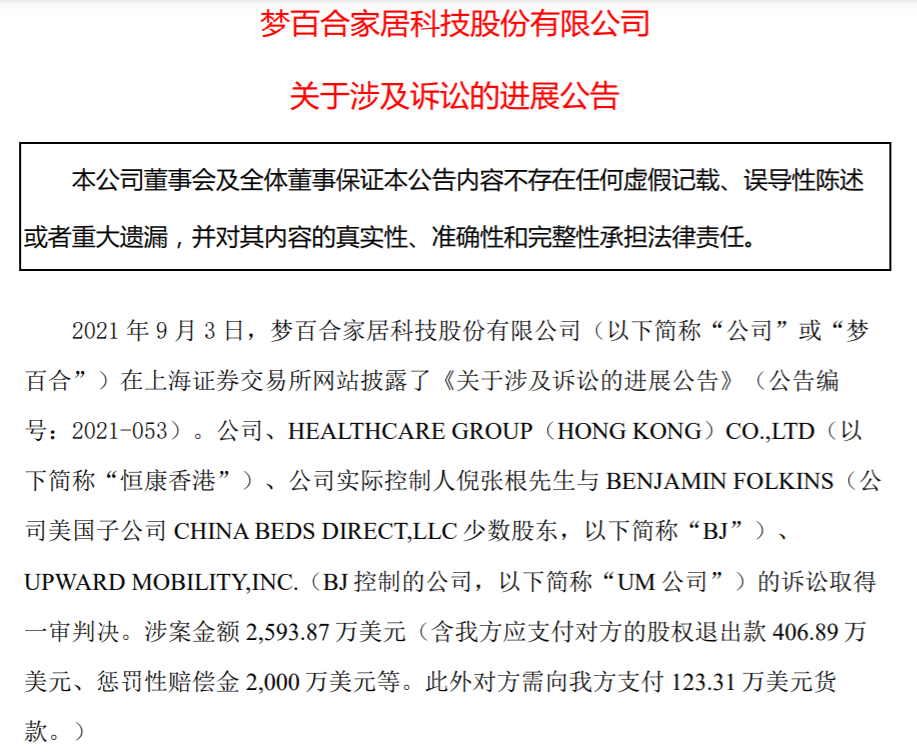

On November 24, Menglily issued an announcement on the progress of the lawsuit, which showed that Menglily, HEALTHCARE GROUP (HONG

KONG) CO., LTD (hereinafter referred to as Hengkang Hong Kong), the company’s actual controller Ni Zhanggen and BENJAMIN FOLKINS (the company’s American subsidiary CHINA BEDS

Minority shareholders of DIRECT, LLC (hereinafter referred to as BJ), UPWARD

MOBILITY, INC. (a company controlled by BJ, hereafter referred to as UM Company), after Meng Lily appealed to the Tennessee Court of Appeals in the United States in the early stage, the Court of Appeal announced the preliminary conclusion in November: the jury’s verdict and the trial court’s judgment It was dismissed and the case was remanded for a new trial.

It is worth noting that in the first three quarters of this year, Mengbaihe achieved a net profit attributable to its parent company of 113 million yuan (approximately US$15.79 million). In the above-mentioned foreign-related equity dispute case, although the amount that Dream Lily had to pay to overseas distributors was reduced from US$24.7056 million to US$17.2741 million, it was still higher than Dream Lily’s net profit attributable to the parent company in the first three quarters of this year. It can be seen that the verdict of this lawsuit is crucial to Meng Lily’s operation.

The day before the announcement (November 23), Mengbaihe Chairman Ni Zhanggen said directly on the social media platform: “Justice will be late, but it will not be absent.” He also said that this is a lawsuit that can be fought with one’s life. , a matter of personal and company dignity.

Image source: Dream Lily Announcement

The case was remanded for retrial

As a company with export revenue accounting for more than 80%, Dream Lily was established in Nantong, Jiangsu in 2003. It was formerly known as Hengkang Home Furnishing. Its main products include memory foam mattresses, pillows and other home products. It is one of the first batch of memory foam products in China. A company that develops, designs, produces and sells household products.

In terms of business scale, in the first three quarters of this year, Mengbaihe achieved operating income of 5.715 billion yuan, second only to Gujia Home Furnishing and Xilinmen, ranking third in the domestic software home furnishing industry.

Around 2011, Dream Lily pursued global development and established joint ventures with local home furnishing companies in Europe and North America, controlled by Dream Lily.

The above-mentioned litigation case revolves around the American Dream Lily Company. Its main business is the retail and wholesale of Mlily brand memory foam home products in North America. Hengkang Hong Kong and Dream Lily’s distributor BJ in the United States hold 55% and 45% of the shares respectively.

At the end of 2016, BJ proposed to withdraw from American Dream Lily and requested to pay it more than US$3 million in accordance with the “Operating Agreement” as consideration for its 35% stake in American Dream Lily. However, Meng Lily refused to pay. Starting in April 2017, BJ filed a lawsuit with the Chancery Court of Hamilton County, Tennessee, USA. Meng Lily, Hengkang Hong Kong and Ni Zhanggen took to the dock.

According to Menglily’s disclosure, on September 3, 2021, the first-instance judgment was obtained in this lawsuit, and the amount involved was US$25.9387 million (including US$4.0689 million that Menglily should pay for BJ’s equity withdrawal, punitive damages of US$20 million, etc.). In addition, , BJ needs to pay a payment of US$1.2331 million to Dream Lily.) On February 11, 2022, Dream Lily announced that the above-mentioned lawsuit had obtained an adjusted judgment issued by the Chancery Court of Hamilton County, Tennessee, USA. The adjusted amount involved in the judgment was 1850.72 million U.S. dollars (including the equity withdrawal payment of $4.0689 million that Menglily should pay to BJ, punitive damages of $11.5161 million, etc. In addition, BJ needs to pay a payment of $1.2331 million to Menglily.)

The adjusted judgment shows that the punitive damages that Ni Zhanggen and Meng Baihe need to pay to BJ have been reduced from the US$20 million in the first instance judgment to US$11.5161 million, and it is clarified that BJ is entitled to compensation of US$977,600 in attorney fees and US$747,000 in litigation costs.

Ten thousand U.S. dollars. In summary, the total amount of fees to be paid by Mengbaihe was adjusted from US$24.7056 million in the first instance judgment to US$17.2741 million, a decrease of US$7.4315 million.

On November 24, Dream Lily disclosed the latest progress of the lawsuit. After the company initially appealed to the Tennessee Court of Appeals in the United States, in November this year, the Court of Appeal announced its preliminary conclusion: the jury’s verdict and the trial court’s judgment were revoked, and the case Was remanded for retrial.

Mengbaihe stated that the Court of Appeal has not yet officially issued the appeal result, and the preliminary conclusion has not yet officially taken effect. The official judgment will be announced on the 30th

Made after the expiry of days. As of September 30 this year, the company recognized estimated liabilities of 124 million yuan based on the adjusted judgment. The outcome of this lawsuit is still uncertain, and its impact on the company’s profits during the reporting period cannot be determined for the time being.Sure.

The day before the announcement was issued, Mengbaihe Chairman Ni Zhanggen said directly on the social media platform: “Justice will be late, but it will not be absent.” He also said that this is a lawsuit that can cost one’s life to fight, and it is about personal and Company dignity.

Ni Zhanggen also shared a screenshot of the chat, which read: “Meng Lily’s appeal was successful. The appeals court found that the original judge’s behavior violated logic and abused discretion. The results of the appeal were announced on the Tennessee Judicial Administration website, causing an uproar.” ”

He also commented: “This is the best Thanksgiving gift (November 23).”

Revenue fell year-on-year in the first three quarters

According to public information, Ni Zhanggen was born in Rugao City, Nantong in 1975. He graduated from Tongji University and is the founder of MLILY brand and chairman of MLILY home furnishing.

Dream Lily landed in the US market in 2012 and the A-share market in 2016 and became the official global partner of Manchester United.

As of June this year, Dream Lily products have been sold in 110 countries and regions. It has six production bases in the United States, Serbia, Thailand, Spain and China, with an annual designed production capacity of more than 10 billion yuan.

It is worth noting that due to the sluggish overseas market, Mengbaihe is facing downward pressure on performance. The financial report shows that in the first half of this year, the company achieved total revenue of 3.601 billion yuan, a decrease of 482 million yuan compared with the same period last year, mainly due to the decline in revenue in the North American market.

To this end, Mengbaihe has increased its expansion into the domestic market. In the first half of this year, the domestic market contributed revenue of 567 million yuan, a year-on-year increase of 19.57%. But overall, revenue from the domestic market only accounts for 15.76% of the company’s total revenue.

From 2020 to 2022, Mengbaihe achieved operating income of approximately 6.53 billion yuan, 8.14 billion yuan, and 8.02 billion yuan respectively, and realized net profits attributable to the parent company of approximately 379 million yuan, -276 million yuan, and 41 million yuan.

In the first three quarters of this year, the company achieved revenue of approximately 5.715 billion yuan, a year-on-year decrease of 5.81%; net profit attributable to shareholders of listed companies was approximately 113 million yuan, a year-on-year increase of 14.36%.

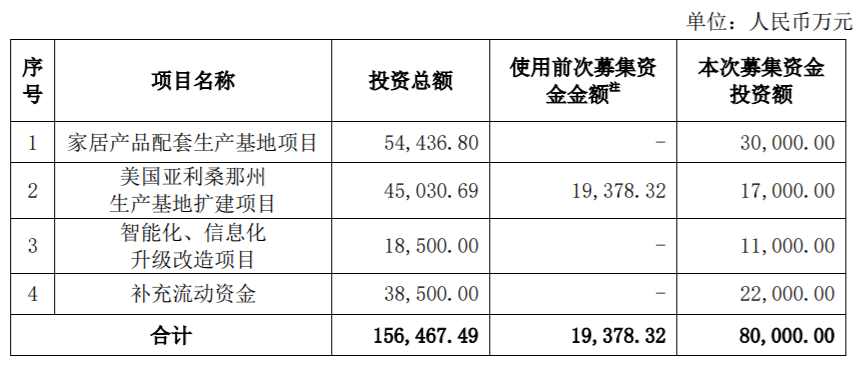

Usage of the planned 800 million yuan raised funds from Mengbai

It is worth mentioning that on November 24, Mengbaihe announced that it would issue 85,287,846 ordinary shares (A) to specific targets at an issue price of RMB 9.38 per share.

Yuan, a total of 799,999,995.48 yuan was raised, and after deducting underwriting and sponsorship fees of 9,399,999.96 yuan, the raised funds were 790,599,995.52

Yuan, which has been remitted to the supervision account of the raised funds by the lead underwriter GF Securities on November 1.

The approximately 800 million yuan raised this time will be used for the investment and construction of three projects under Mengbaihe and to supplement working capital.

微信扫一扫打赏

微信扫一扫打赏