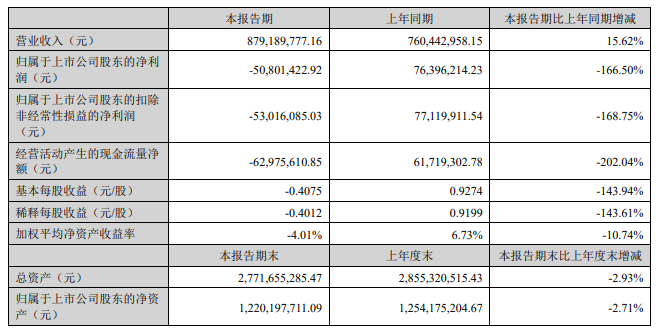

On August 23, Yida shares released the 2023 semi-annual financial report, which showed that in the first half of the year, Yida shares achieved operating income of 879 million yuan, an increase of 15.62% over the same period last year, but a net profit loss of 50.8 million yuan attributable to the parent, a year-on-year loss of 50.8 million yuan. A substantial decrease of 166.50%, net profit attributable to the parent company after deducting non-existing items decreased by 168.75% year-on-year; net cash flow was -62.98 million yuan, a sharp drop of 202.04% from the same period last year; basic earnings per share was -0.4074 yuan per share, which also fell sharply 143.94%.

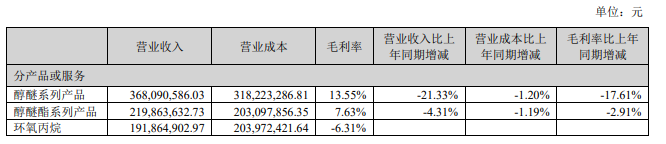

In the first half of 2023, Yida has added sales of propylene oxide and hydrogen peroxide. Among them, Taixing Yida, a holding subsidiary with an annual output of 150,000 tons of propylene oxide project, obtained a safety production license issued by the Jiangsu Provincial Emergency Management Department on February 17 for production. The sales revenue of propylene oxide products was 192 million yuan, accounting for the majority Operating income was 22.17%; gross sales profit was RMB 12.1075 million, accounting for -17.91% of main business sales gross profit. Propylene oxide products were not sold in the same period last year. At the same time, Taixing Yida’s annual output of 150,000 tons of propylene oxide project was completed and carried forward to fixed assets. The amount of depreciation and amortization in the first half of the year increased by 52.26 million yuan year-on-year.

As the main product of Yida, the sales volume of alcohol ether and alcohol ether ester products in the first half of the year increased by 15.13% year-on-year, and the market share increased. However, affected by market competition and downstream demand, the average sales price of alcohol ether and alcohol ether ester products Compared with the same period last year, it decreased by 26.80%, resulting in a year-on-year decrease of 13.04% in sales gross profit margin.

Factors such as the commissioning of new projects and the decline in product sales prices have caused the failure to achieve overall profitability in the first half of 2023. Yida shares said that in the next stage of work, it will conscientiously do a good job in safety production, environmental protection and other aspects of work, seize the favorable opportunity of domestic economic recovery, strive to do a good job in production and operation, improve the company’s profitability and operating performance, and contribute to the company’s future. Lay the foundation for long-term stable development.

Regarding the propylene oxide products that Yida is newly involved in, according to Huizheng Information, in the first half of 2023, the downstream consumption of propylene oxide will mainly be polyether polyols, accounting for 81.93%, followed by propylene glycol, accounting for 8.28% , the third is the propylene glycol ether industry, accounting for 5.71%. In the first half of 2023, the capacity utilization rate of domestic propylene oxide plants is low, only 67%, and the overall price shows the characteristics of rising first and then falling. In the middle and late February, a number of equipment storage and maintenance plans began, and the market expectations were tight, which made the price of propylene oxide reach the highest point of 11,300 yuan/ton in the year. After that, the market demand did not rebound significantly. The price fluctuates within a narrow range of 9,000-10,000 yuan/ton. In the first half of 2023, the domestic average price of propylene oxide was 9,578 yuan/ton, a year-on-year decrease of 13.09%.

Although it failed to achieve an overall profit in the first half of the year, Yida still maintains the stable operation of the company by virtue of its core competitiveness. As the setter of alcohol ether industry standards and the first drafter of propylene oxide green design products, Yida has always put product innovation in the first place. Implementing the concept of “high-quality development, green development, and energy-saving development”, through continuous increase in investment, a research and development system with independent innovation capabilities, sufficient technical reserves and new product industrialization capabilities has been formed, with continuous independent innovation capabilities.

In terms of products catering to market demand, relying on years of experience in the production of alcohol ethers and alcohol ether esters, and through independent research and development combined with foreign advanced technology, Yida has formed a unique “flexible production” feature, which can be flexibly adjusted according to market demand. Product output, allocation of alcohol ether and alcohol ether ester product types, and timely launch of products that meet market demand. Yida Co., Ltd. continues to develop and refine the existing products to form a multi-spec and multi-variety product group, and increase product upgrading and application field expansion to improve product profitability and market space.

In order to ensure the stability of the supply chain and continue to reduce costs, Yida Co., Ltd. extends upstream, owns the self-developed direct oxidation (HPPO) propylene oxide complete set of technology and builds an annual output of 150,000 tons of propylene oxide production equipment. This technology is The green and environmental protection technology encouraged by national policies can solve the problem of stable supply of core raw materials and effectively reduce the cost of the company. Do a good job in the application promotion and service demonstration of the technology of HPPO legal production of propylene oxide. And make the industrial chain bigger and stronger, and increase the comprehensive utilization of series products, so as to effectively improve the gross profit rate of products and the utilization rate of raw materials.

In terms of production capacity layout, relying on the strategic layout of “Three Rivers and Four Regions”, Yida has achieved the goal of being close to raw materials, close to the market and facing the world, forming a competitive advantage of low raw material procurement costs, low transportation costs and reasonable production capacity layout. Through the supporting implementation of the storage tank farm in Zhuhai, the production cost can be further reduced, and it provides a channel for the company’s products to enter the international market.

In terms of the development and maintenance of key downstream customers, Yida has integrated into the core supply system of major customers such as BASF and Dongjin Smicon.�As a link in the international supply chain, it will gradually benefit from the growth in demand brought about by the expansion of the international giant’s market and the development of new products, laying a good foundation for the company’s sustainable development.

微信扫一扫打赏

微信扫一扫打赏