On July 10, 2018, the Office of the United States Trade Representative announced a new round of proposed tariff list, saying that it would impose an additional 10% tariff on Chinese goods worth 200 billion U.S. dollars. In this list, the important downstream of polymeric MDI: the refrigerator is impressively listed. On August 1, 2018, the incident escalated again, and the tariff was raised from 10% to 25%. Recently, Trump has even threatened to impose tariffs on all Chinese exports to the United States. As of a few days ago, China and the United States are still negotiating whether to implement this $200 billion tax list.

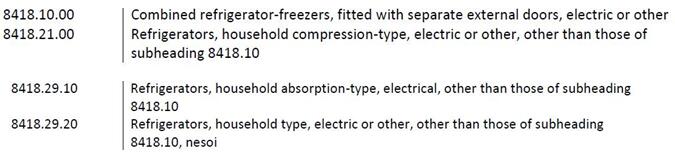

Table 1. Sales and export of refrigerators in China in 2017

Referring to industry online data, China’s air-conditioning production capacity accounts for 52% of the world’s total in the complete machine manufacturing process. In 2017, China sold a total of 87.27 million refrigerators, of which 35.73 million were exported, accounting for 41% of the total sales. The number of Chinese refrigerators exported to the United States is about 6.79 million units, accounting for 19% of the total export volume, or 7.7% of the total sales volume.

So, if the U.S. finally decides to impose additional tariffs on $200 billion worth of goods, resulting in an increase in tariffs from Chinese refrigerators to the U.S., the aggregation of on China How will the MDI market be affected? Due to the difference in refrigerator capacity, the amount of foaming material in each refrigerator is also different. Roughly estimated, the polymeric MDI needed to produce a refrigerator is about 3-4kg. Therefore, in 2017, the polymeric MDI required for the production of refrigerators exported to the United States was around 20,000-27,000 tons. According to the statistics of Tiantian Chemical Network, in 2017, the sales volume of polymeric MDI was about 1.11 million tons. Therefore, the polymeric MDI used in the production of refrigerators exported to the United States accounts for Polymerized MDI accounts for 1.8%-2.4% of the total output, the amount is so small, macroscopically and in the long run, it will not affect China’s MDI market impact. However, if a tax increase is imposed, it may cause small fluctuations in the market in a short period of time.

微信扫一扫打赏

微信扫一扫打赏