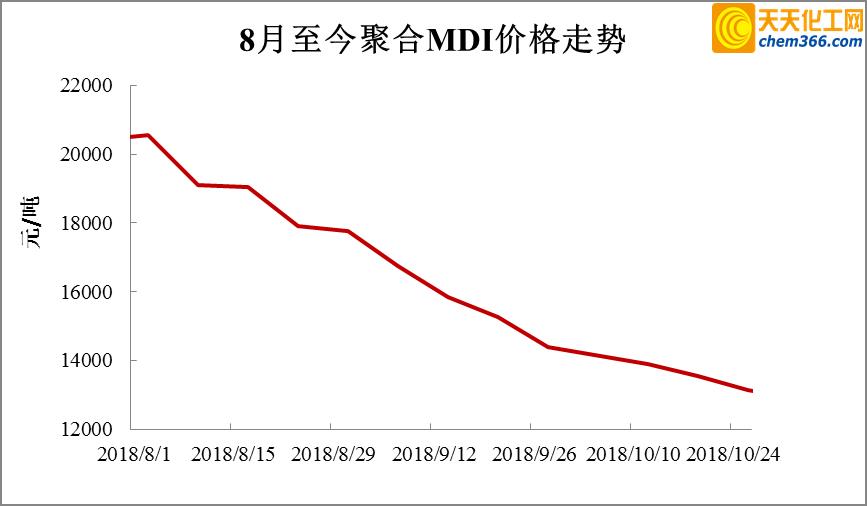

Since August, the price of polymeric MDI dropped from 20,000 yuan/ton to 13,000 yuan/ton, The drop was as high as 7,000 yuan/ton. During what should have been the peak season, market prices fell below expectations time and time again, causing panic to spread unavoidably in the venue. At the same time, the Golden Nine and Silver Ten has come to an end, and the future seems to be even more difficult. But looking at the recent supply and demand situation, maybe the market is not as bad as imagined?

1. Supply side

Wanhua Chemical: The buyout price for listing and settlement in November is 14,200 yuan/ton, which is close to the market price. At the same time, the Ningbo MDI plant maintenance plan was announced, as follows: The first phase of the MDI plant (400,000 tons/year) will start to shut down on November 1, 2018, and the maintenance is expected to be about 22 days; the second phase of the MDI plant (800,000 tons/year) The parking will start on December 1, 2018, and the maintenance is expected to take about 31 days.

Covestro: I heard that the ex-factory price of Covestro last week was 12,800 yuan/ton, and the supply side is more flexible. At the same time, Covestro has not overhauled this year, and may have an overhaul plan in November.

BASF: The listed price in November is 14,200 yuan/ton, and the supply on the site is normal. At the same time, I heard that the heavy bus has a maintenance plan in December, and it is still unknown whether it will reduce production due to the shortage of natural gas supply.

Huntsman: The listed price in November is executed at 14,200 yuan/ton, and the on-site supply is normal.

Dongcao Ruian: I heard that the new ex-factory price is 12,800 yuan/ton, and the supply is normal.

Imported goods: At present, the supply of imported goods is less. On the one hand, it may be because of the Shanghai Import Expo, and logistics will have a short-term impact; on the other hand, the current price in China is at a low point in the world. the best choice. It is heard in the venue that Tosoh’s supply will resume quotations next week, but with the negotiation and shipping time, the arrival of the goods may not be until mid-to-late November; Kumho’s current quotation is relatively high, and it is heard that CIF China is about 1,500 US dollars; Dow’s supply is in the late stage The volume to the Chinese market may decrease.

Second, demand

Since this year, weak demand has been lingering in the polymeric MDI market, environmental storms, 141B price surges, trade A series of events such as wars have a certain impact on the market. Overall, in 2018, the application of black materials in industries such as automobiles, refrigerated containers, adhesives and sealants may increase slightly, while the application in industries such as refrigerators, freezers, and water heaters may remain stable or decline slightly. In November-December, it is expected that the output of the refrigerator industry will be at a low level in November-December, and the demand for external wall insulation, pipe insulation and other industries will be greatly reduced, but the freezer and automobile industries may usher in a small decline in the second half of the year from November to December. peak.

3. Market outlook

The impact of weak downstream demand on black materials has been reflected in the sharp drop in black material prices, and the impact of weak demand on the black material market has been overreacted. Overall, in November, the supply of polymeric MDI is tight, and the market will mainly operate stably, while paying close attention to changes in the supply side. The possibility of short-term price increases due to tight supply cannot be ruled out.

微信扫一扫打赏

微信扫一扫打赏