In 2018, polyether import and export experienced the Sino-US trade war, and enjoyed the preferential policy of increasing the export tax rebate rate in November, which can be described as quite twists and turns. Judging from the current data from January to October, both imports and exports have increased to varying degrees.

From January to October 2018, the total import volume of polyether in China was 317,000 tons, a year-on-year increase of 19.62%; the total export volume of polyether reached 277,000 tons, a year-on-year increase of 12.6%.

the

January-October 2017 | January-October 2018 | YoY Growth Rate | |

Import volume | 26.5 | 31.7 | 19.62% |

Export volume | 24.6 | 27.7 | 12.6% |

the

one. import

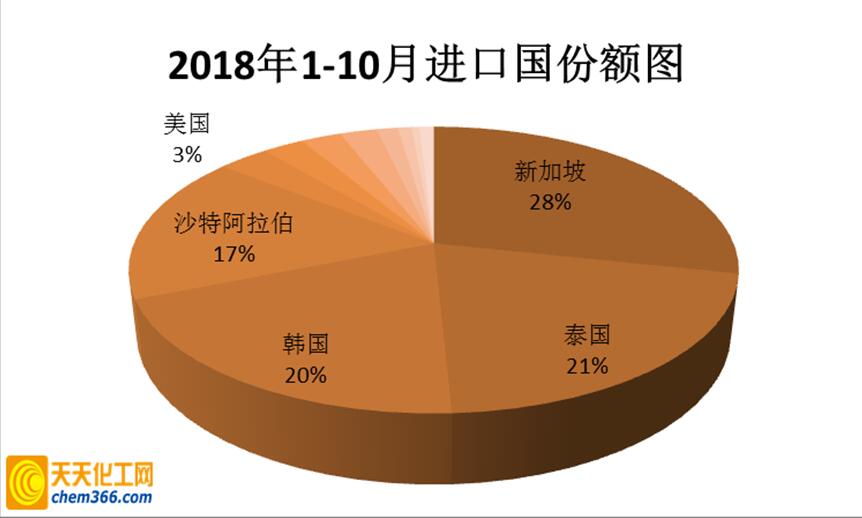

Singapore, Thailand, South Korea, Saudi Arabia and the United States are the top five import source countries in 2018. From January to October 2018, imports from Singapore were 95,000 tons, Thailand was 70,000 tons, South Korea was 66,000 tons, Saudi Arabia was 56,000 tons, and polyether imports from the United States were 11,000 tons.

From January to October 2017, the top five import source countries or regions were Singapore, Thailand, the United States, South Korea and Taiwan, China, and the import volumes were: 73,400 tons, 73,000 tons, 29,000 tons, 18,000 tons and 9,000 tons .

Compared with 2017, China’s imports from the United States have dropped significantly. The trade between China and the United States was greatly affected and impacted in 2018 due to the shadow of the trade war. On June 15, 2018, the U.S. government released a list of goods subject to additional tariffs. It will impose 25% tariffs on about US$50 billion of goods imported from China, of which about US$34 billion of goods have been imposed since July 6, 2018. At the same time, it began to solicit public opinions on the imposition of additional tariffs on about 16 billion US dollars of goods. Polyether polyols are listed in the US$16 billion product list. Since August 23, the United States has officially imposed a 25% tariff on polyether products from China. However, in December, China and the United States released a signal of relaxation, and the Sino-US trade situation may improve.

the

the

two. exit

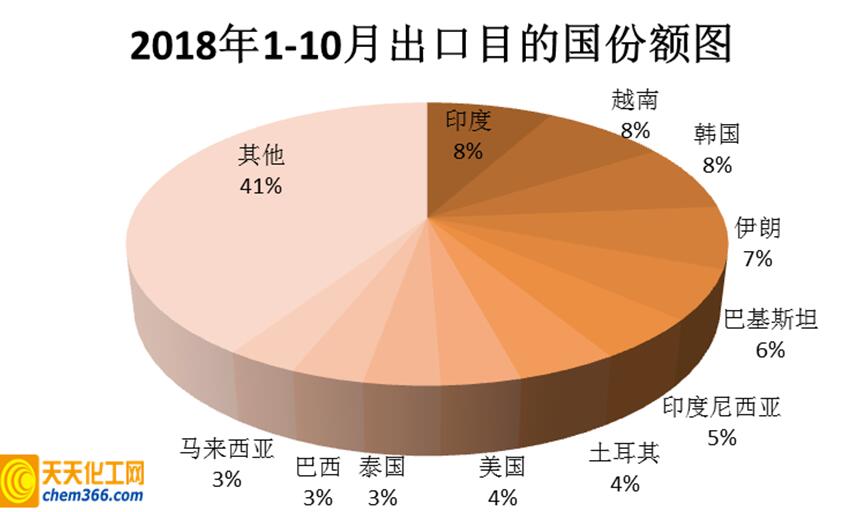

From January to October 2018, China exported a total of 277,000 tons of polyether, of which India, Vietnam, South Korea, Iran and Pakistan were the top five countries with the largest export volume in the past 10 months. During the period, China exported 27,000 tons of polyether to India, 26,000 tons to Vietnam, 25,000 tons to South Korea, 23,000 tons to Iran and 19,000 tons to Pakistan.

In the same period of 2017, the top five export destination countries were South Korea, Turkey, Pakistan, India and Vietnam, and the corresponding export volumes were: 28,000 tons, 25,000 tons, 16,000 tons, 15,000 tons and 15,000 tons.

From the data, it can be intuitively felt that China’s exports to Turkey have been greatly affected. The Turkish economy has been unstable in 2018, with the lira experiencing a flash crash in early August. The fluctuating exchange rate, the sanctions imposed by the United States and a series of factors have caused the level of difficulty in doing trade with Turkey to soar, and exports have been greatly affected.

The increase in exports to Iran this year is a side effect of the Sino-US trade war. The early summer saw U.S.-China trade tensions and the U.S. government announced a new round of sanctions on Iran. China ramped up its trade with Iran during that time, and exports soared.

the

The State Council Information Office held a press conference at 10 a.m. on January 14, 2019 (Monday). The spokesperson of the General Administration of Customs said that with my country’s further opening up and the deepening of supply-side structural reforms, it is expected that my country will The development of foreign trade is expected to improve steadily, and the quality and efficiency will be further improved. Then the polyether import and export market may also maintain a stable general tone in 2019.

the

the

the

the

微信扫一扫打赏

微信扫一扫打赏