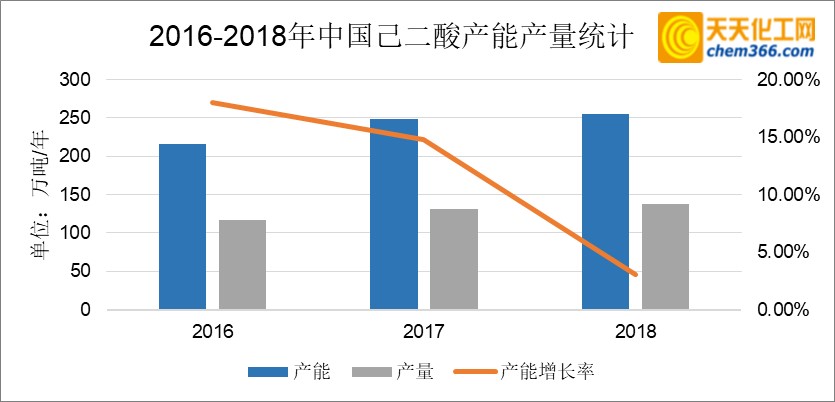

In recent years, the growth rate of my country’s adipic acid production capacity is greater than that of downstream demand. Domestic suppliers are facing fierce market competition due to overcapacity. In 2016, Henan Shenma , Shandong Hongda’s new production capacity is still being released, and domestic production capacity is constantly rising, with a total domestic production capacity of 2.16 million tons per year. In 2017, the new production capacity of Shanxi Taiyuan Chemical and Chongqing Huafon continued to be released, and the risk of overcapacity continued to accumulate. With the new production capacity of Huafon adipic acid put into operation at the end of 2017, the total domestic production capacity in 2017 reached 2.48 million tons per year. In 2018, Shenma’s 75,000-ton/year adipic acid plant was put into operation, and China’s total adipic acid production capacity reached 2.555 million tons in 2018. China has become an important AA production base in the world.

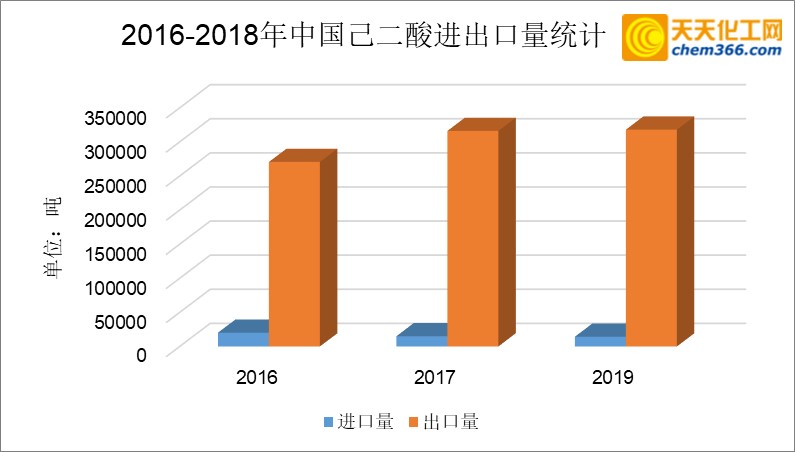

According to the data of Tiantian Chemical Network, the import volume of adipic acid has shown a decreasing trend in the past three years. Among them, the total import volume of adipic acid in 2018 was about 14,000 tons, a year-on-year decrease of 4.29%. It is estimated that in the next five years, the decline in China’s adipic acid imports will remain around 5%. In 2018, the export volume of adipic acid was about 320,000 tons, a year-on-year increase of 0.6%.

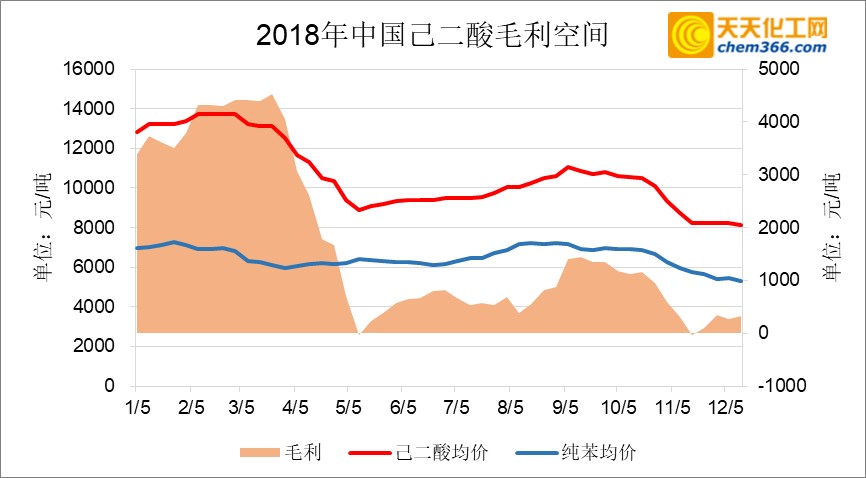

From the perspective of the market price of adipic acid in 2018, the fluctuation range is relatively large, and the difference between the peak and the valley of the price can reach 5,500 yuan/ton; Due to the tight supply of domestic manufacturers and the low inventory of the holders; and in the fourth quarter, the profit of the adipic acid market was severely compressed, which was mainly limited by the downstream demand.

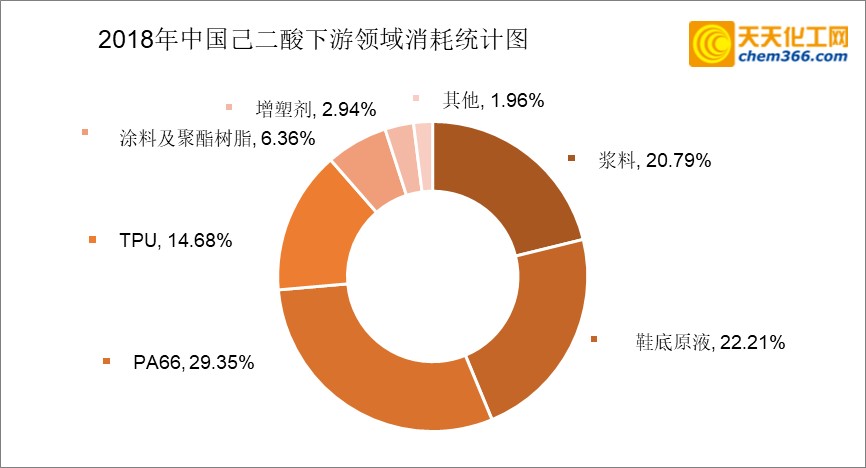

The consumption structure of adipic acid in my country is mainly based on the PU industry (slurry, sole liquid, TPU), nylon 66, in recent years, TPU and nylon 66 are developing rapidly, and as TPU and The demand for adipic acid, the upstream raw material of nylon 66, will also increase accordingly.

In the Chinese market, sole stock solution, slurry and PA66 industries are the main consumption areas of AA. In 2018, the AA consumption accounts for AA consumption Nearly 70%; and as the most important nylon field in the world, the consumption of AA has increased compared with previous years. The expansion of production capacity and the release of new production capacity have led to an increase in the consumption of AA for nylon. The consumption of adipic acid in the domestic nylon industry accounts for about 29.31%. .

微信扫一扫打赏

微信扫一扫打赏