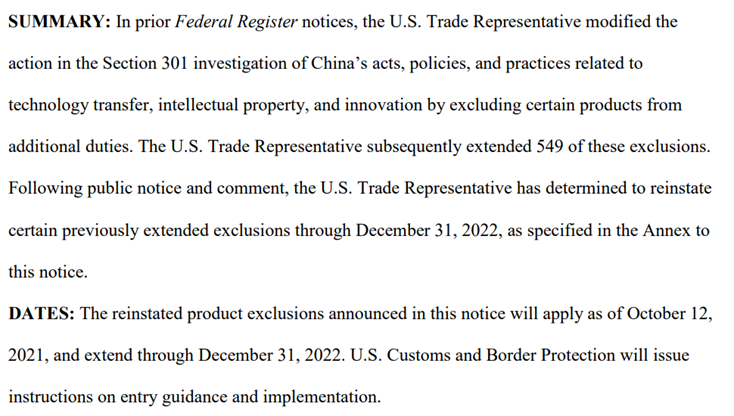

On March 23, 2022 local time, the Office of the United States Trade Representative (USTR) issued a statement announcing Re-exempt the tariffs on 352 items imported from China. This new regulation will apply to goods imported from China between October 12, 2021 and December 31, 2022. The office stated that the U.S. decision on the day was the result of a comprehensive solicitation of public comments and consultations with relevant U.S. agencies.

It is mentioned in the attachment of the USTR statement: “In the previous “Federal Register” notice Among other things, the U.S. Trade Representative amended the actions of the Section 301 investigation regarding Chinese technology transfer, intellectual property, and innovation conduct, policies, and practices to exclude certain products from additional tariffs. USTR 549 of these exclusions were subsequently extended.”

According to Tiantian Chemical Network in 2019, the United States has additional PU raw materials imported from China It can be seen from the table of tariff collection (see the table below for details) that a variety of polyurethane raw materials have been included.

Form:The United States imposes additional tariffs on PU raw materials imported from China

|

product name |

original tariff |

additional levy |

effective date |

|

polyether polyol |

6.5% |

25% |

2018year8month23Day |

|

Propylene oxide |

5.5% |

25% |

2019year5month10day |

|

polymerizationMDI |

6.5% |

25% |

2019year5month10day |

|

TDI |

6.5% |

25% |

2019year5month10day |

Therefore, everyone can’t help but be concerned about the re-exemption of 352 items of Chinese import tariffs announced by the United States. What about the above list, as well as other polyurethane raw materials and their downstream products?

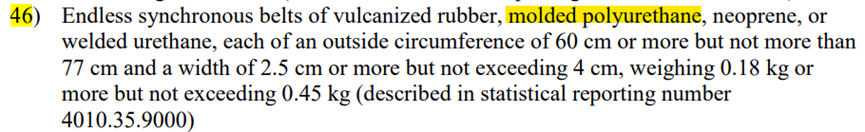

The editor of Tiantian Chemical Industry Network checked the exemption list published by USTR and found that in the above table None of the PU raw materials are included. The items related to polyurethane in the list are also relatively limited, including the following two items:

- Polyurethane material: Molded polyurethane (polyurethane) molding

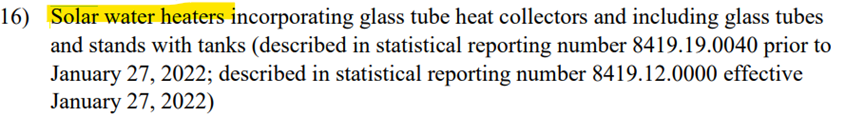

- Polyurethane downstream industry: Solar water heaters

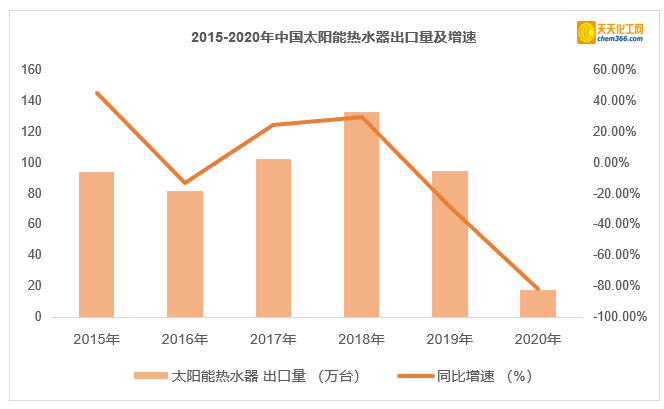

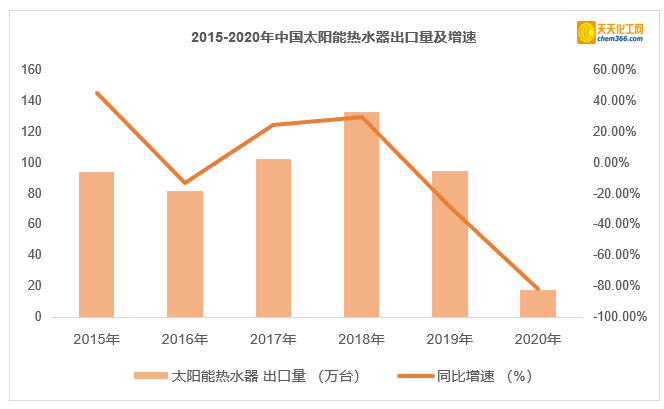

According to relevant industry data, from 2015 to 2017, China’s annual export volume of solar water heaters was 800,000 to 1 million In 2018, it reached a peak of around 1.35 million units in recent years, and the export volume declined significantly in 2019-2020. The news of this tariff exemption is good for the export competitiveness of domestic solar water heater manufacturers. But overall, the news that the United States has re-exempted imported goods from tariffs has little impact on the domestic polyurethane industry.

-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:104px”>

25%

2019year5month10day

Therefore, everyone can’t help but be concerned about the re-exemption of 352 items of Chinese import tariffs announced by the United States. What about the above list, as well as other polyurethane raw materials and their downstream products?

The editor of Tiantian Chemical Industry Network checked the exemption list published by USTR and found that in the above table None of the PU raw materials are included. The items related to polyurethane in the list are also relatively limited, including the following two items:

- Polyurethane material: Molded polyurethane (polyurethane) molding

- Polyurethane downstream industry: Solar water heaters

According to relevant industry data, from 2015 to 2017, China’s annual export volume of solar water heaters was 800,000 to 1 million In 2018, it reached a peak of around 1.35 million units in recent years, and the export volume declined significantly in 2019-2020. The news of this tariff exemption is good for the export competitiveness of domestic solar water heater manufacturers. But overall, the news that the United States has re-exempted imported goods from tariffs has little impact on the domestic polyurethane industry.

微信扫一扫打赏

微信扫一扫打赏