India is one of the fastest growing economies in the world,In 2021, India’s GDP will hit a record high, breaking through $3 trillion for the first time. With the increase of urbanization and per capita disposable income, India’s polyurethane industry is developing steadily, mainly driven by the growth of demand in refrigerators, furniture mattresses, and shoe materials industries. India’s Gujarat Narmada Valley Fertilisers & Chemicals (GNFC) is a local TDI supplier and has two TDI factories with a total annual production capacity of 67,000 tons/year. There is no local MDI production device, and all MDI products consumed are imported, and the sources of goods include manufacturers in China, South Korea and Japan.

TDI

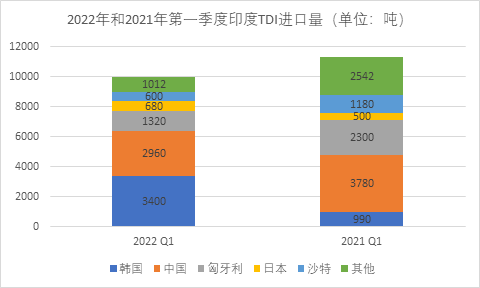

In 2022, India’s TDI imports continued to rise for three consecutive months. In the first quarter, India imported a total of 9,971 tons of TDI, a decrease of 11.7% from the same quarter in 2021. In terms of import sources, South Korean producers provided the highest amount of TDI in the quarter, accounting for 34% of total imports, followed by Chinese producers and Hungary (Wanhua Bosu), accounting for 30% and 13% of the total respectively , Japanese and Saudi (Sadara) producers ranked fourth and fifth respectively.

By withComparing the first quarter of 2021, it can be seen that India’s TDI imports from all manufacturers except South Korea and Japan have decreased. In terms of changes in the proportion of manufacturers in India’s imports, among them, Hungarian manufacturers decreased the most, accounting for a decrease of 7.1% compared with the same period, and other manufacturers were all below 5%. The import proportion of South Korean manufacturers increased from 8.8% in the same period last year to 34.1%, becoming the largest source of imports in the first quarter of 2022.

table1. Comparison of India’s TDI import sources in the first quarter of 2022 and 2021 (unit: tons, %)

|

|

2022 Q1 |

2021 Q1 |

YoY change |

|

Korea |

3400 |

990 |

243.4% |

|

China |

2960 |

3780 |

-21.7% |

|

Hungary |

1320 |

2300 |

-42.6% |

|

Japan |

680 |

500 |

36.0% |

|

Saudi Arabia |

600 |

1180 |

-49.2% |

|

Other |

1012 |

2542 |

– |

|

Total |

6058 |

-36.6% |

|

|

Netherlands |

1442 |

583 |

147.3% |

|

Other |

1375 |

7730 |

– |

|

Total |

33733 |

45403 |

-25.7% |

In the first quarter of 2022, India’s imports of TDI and MDI decreased compared with the same period last year, and the decrease of PMDI was higher than that of TDI. South Korean producers performed strongly in Indian exports. In 2022, India will maintain stable and rapid economic growth, and the demand for isocyanates will continue to be stable.

-25.7%

In the first quarter of 2022, India’s imports of TDI and MDI decreased compared with the same period last year, and the decrease of PMDI was higher than that of TDI. South Korean producers performed strongly in Indian exports. In 2022, India will maintain stable and rapid economic growth, and the demand for isocyanates will continue to be stable.

微信扫一扫打赏

微信扫一扫打赏