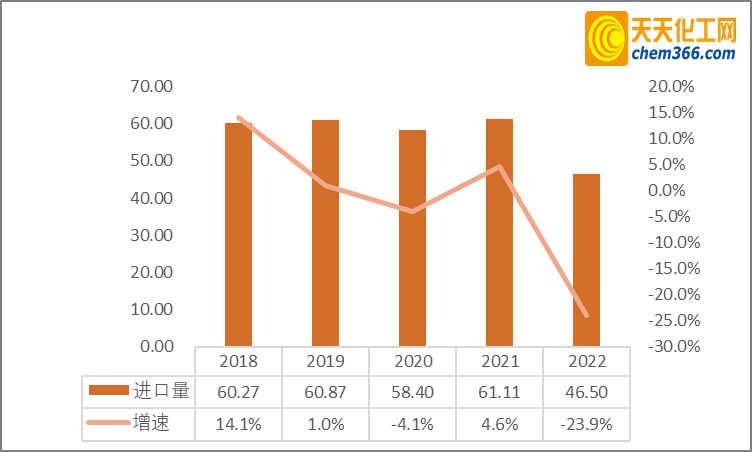

The structure of polyether polyol products in China is out of balance, and the degree of dependence on raw materials is high. In order to meet downstream consumer demand, high-quality polyethers are also continuously imported from overseas. Dow’s supply from Saudi Arabia and Singapore Shell are still the main import sources of polyethers in China. According to China Customs data, the import volume of other polyether polyols in primary form in 2022 will be46.5010,000 tons, a year-on-year decrease of 23.9%. The source of imports covers a total of 46 countries or regions,mainly from Singapore, Saudi Arabia, Thailand, South Korea, Japan.

Figure 1 2018-2022 primary shape of other poly Ether polyol import volume and growth rate (unit: 10,000 tons, %)

With the release of epidemic control, downstream consumer demand has been continuously released,Chinese polyether manufacturers have gradually begun to expand the production capacity of their production equipment. In 2022, China’s polyether polyol import dependence will drop significantly. At the same time, the increase in production capacity will also lead to the structural surplus of the domestic polyether polyol market is becoming more and more obvious, and the price competition among enterprises is fierce. Solve the problem of overcapacity.

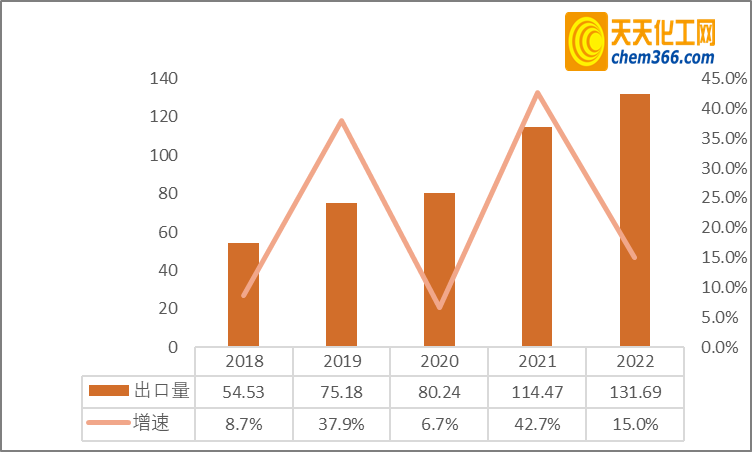

2018-2022In 2019, the export volume of polyether polyols in China continued to increase, with a compound annual growth rate of 24.7%. In 2022, the export volume of other polyether polyols in primary forms will be 1.3169 million tons, a year-on-year increase of 15%. The export covers a total of 157 countries or regions around the world,From the perspective of export destinations, Vietnam, the United States, Turkey, and Brazil are the main export regions of China’s polyether polyols, mainly rigid foam polyols.

Fig. 2 2018-2022 primary shape other poly Ether polyol export volume and growth rate (unit: 10,000 tons, %)

According to the latest IMF January It is predicted that China’s economic growth is expected to reach 5.2% in 2023. The boost of macro policies and strong development momentum reflect the resilience of China’s economy. The confidence of Chinese consumers has increased, consumption has recovered, and the demand for high-quality polyethers in the terminal market has increased, and the import of polyethers will usher in a small increase. In 2023, with the expansion of production capacity of polyether polyols by manufacturers such as Wanhua Chemical, Yinuowei Phase III, and Jiahua Chemical, it is estimated that the total new production capacity will reach 1.72 million tons, and the domestic polyether supply will further increase. Difficulty digesting the domestic market, leading manufacturers turned their attention to foreign countries. The rapid recovery of China’s economy will continue to drive the global economic recovery. The IMF predicts that the global economic growth rate will reach 3.4% in 2023. The development of downstream industries will definitely drive the demand for polyether. It is expected that the export of polyether will further increase in 2023.

微信扫一扫打赏

微信扫一扫打赏