Automobile is a country’s strategic pillar industry. In Germany, which enjoys the title of “Nation of Automobile Industry”, the automobile industry accounts for a large part of exports. Germany is not only the largest automobile market in Europe, but also the birthplace of well-known automobile brands such as Volkswagen, Porsche, Mercedes-Benz, Audi and BMW, as well as the birthplace and brand hinterland of internal combustion locomotives in the world. According to a survey by relevant agencies, the average age of new car buyers in Germany has climbed to 53 years old, which means that the German auto industry is facing a difficult future. As the engine of the EU economy, once the German economy stalls, it will affect the recovery process of the entire EU economy.

Recently, the German Federal Motor Transport Administration stated that after two consecutive years of sharp declines due to the new crown epidemic and supply chain bottlenecks, German car production, Sales pick up again in 2022.

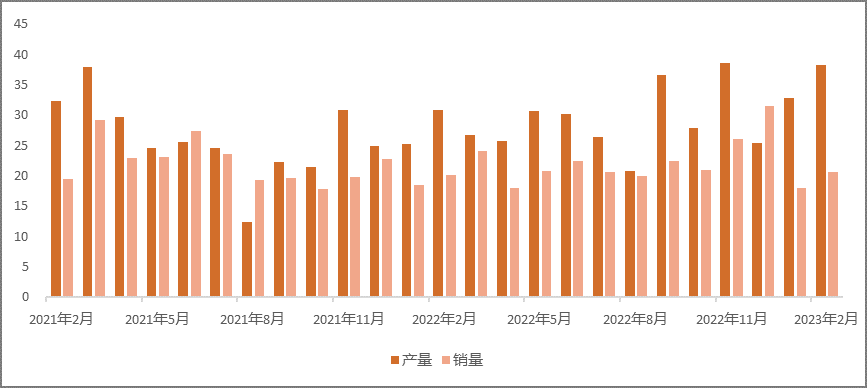

Figure 1 Production and sales of automobiles in Germany from February 2022 to February 2023 (unit: ten thousand units)

Source: German Automobile Industry Association (VDA)

Due to the improvement in the supply of raw materials and intermediate products, German car production will continue to increase in January and February 2023, but the cumulative Production was still at a low level, down 13% compared to the same period in 2019 before the pandemic. In 2022, German passenger car production will be 3.45 million units, a year-on-year increase of 11.4%. As the only country showing growth in major European auto markets, Germany will sell a total of 2.65 million cars in 2022, a slight increase of 1.1% year-on-year, and car sales will pick up slightly. About 1 million fewer than in 2019 before the outbreak. In 2020 and 2021, sales in the German auto market will drop by 19% and 10.1% month-on-month, respectively. It is understood that the German auto market will gradually recover from the second half of 2022, and sales in December increased by 38.1% year-on-year.

2022 Among the new cars sold in the German market in 2019, the sales of gasoline vehicles and diesel vehicles fell by 11.2% and 9.9% respectively, while the sales of pure electric vehicles increased by 32.2% year-on-year. Reached more than 470,000 vehicles, accounting for 17.7% of the market share. Under the constraints of the EU’s strict emission laws, major car companies have accelerated changes and layouts, and the German new energy vehicle industry is also experiencing rapid development.

Figure 2 German passenger car export volume and growth rate from 2018 to 2022 (unit: million units)

Source: German Automobile Industry Association (VDA)

The supply chain interruption during the epidemic and the anti-globalization trend have also brought huge challenges to German auto exports. The downstream is distributed all over the world, and felt the “skin pain” in this supply chain chaos. In 2021, German passenger car exports will drop by 10.3% to 2.374 million units, reaching a historical low since 1996. Compared with 2017, exports fell by about 2 million units. As the impact of the epidemic gradually subsides, in 2022, the export of passenger vehicles will increase by 11.5% year-on-year to approximately 2.65 million vehicles.

As the locomotive of the European economy, the German economic situation has attracted widespread attention. In 2023, German auto production will still be affected by the continued shortage of key components such as chips, and the situation in the auto industry remains “worrying”. Preliminary data released by the German Federal Statistical Office on January 3 showed that the German inflation rate will reach 7.9% in 2022, while the inflation rate in 2021 will be only 3.1%. The Bundesbank predicts that the German inflation rate will remain above 7% in 2023. Under high inflation, consumers’ “declining purchasing power” will limit German car sales in 2023.

微信扫一扫打赏

微信扫一扫打赏