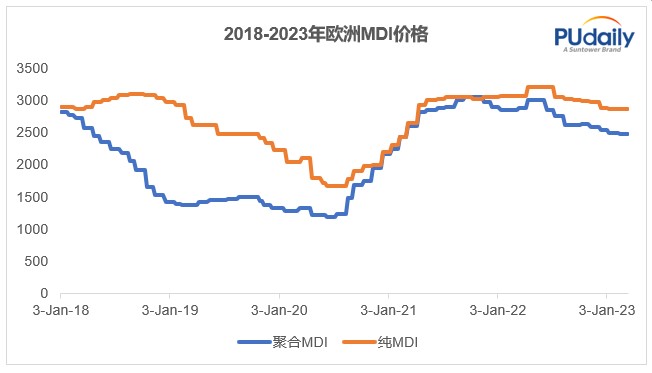

On March 2, 2023, Covestro released its 2022 group financial report: “Global challenges have had a significant impact on Covestro’s performance in fiscal year 2022. Among them, the sharp rise in energy and raw material prices, especially In Europe, it has brought enormous pressure to the company. The overall slowdown in global economic growth and the continued adverse effects of high inflation are even worse. According to Covestro’s estimates, global MDI demand will increase by 0.2% year-on-year in 2022, from The sharp rise in energy and raw material prices (especially in Europe), the slowdown in global economic growth and high inflation have also led to a significant slowdown in the growth rate of global MDI consumption.

In 2023, some European and American MDI production capacity will be shut down, and the global operating rate will drop

On February 21, before Covestro released its financial report, Huntsman, another global polyurethane producer, said in its earnings conference call for the fourth quarter of 2022: “In this quarter, the company’s sales volume increased moderately. European demand remains Downturn… In response to the high energy cost environment, we will be idling a smaller MDI line in Rotterdam, The Netherlands for an extended period until end-market demand improves… In the US, we have closed our Geismar facility due to inflation Part of the production capacity of MDI (accounting for about 30% of the total production capacity).” According to the calculation of the company’s spokesperson, the current global MDI operating rate is about 70%. This level is lower than the normal level of the industry. (According to the statistics of Tiantian Chemical Network, the MDI production capacity of Huntsman in the Netherlands and the United States is 470,000 tons/year and 500,000 tons/year respectively. A total of about 300,000 tons/year.)

Because of the decline in the operating rate of MDI plants in Europe and the United States, as well as the high support of upstream energy and raw material costs, the negotiated price of the MDI market in Europe is relatively stable at present. Tons or so, and presents a situation of both supply and demand.

Building:

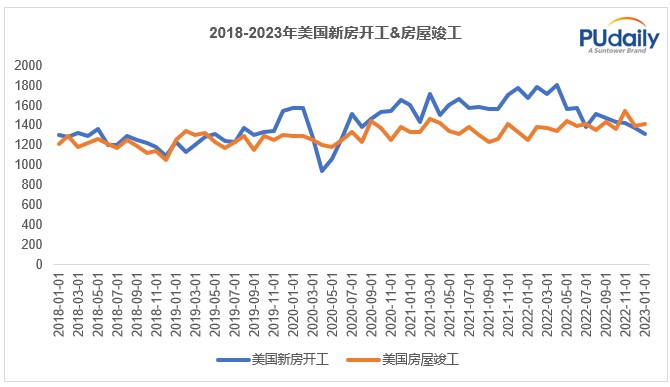

The construction industry is the most important downstream industry of MDI in Europe and America. According to a large MDI manufacturer, in the American market, about 2/3 of their polyurethane business has entered the local construction industry, of which about half have entered commercial buildings and the other half have entered residential buildings. In civil housing, about 70% of the proportion is related to new housing.

United States:

According to Federal Reserve Economic Data (Federal Reserve Economic Data), in 2022, the number of new housing starts in the United States will total 18,667 thousand, a year-on-year decrease of 3.1%. From 2020 to 2021, the U.S. real estate market will recover rapidly after the impact of the new crown epidemic, and it will evolve into the most prosperous “real estate boom” since the subprime mortgage crisis in 2007. Since 2022, the real estate market has been the first to bear the brunt of the Fed’s aggressive tightening. Indicators such as housing sales and market sentiment have cooled to a degree comparable to the subprime mortgage crisis in 2007-2008. Looking forward to 2023, it is expected that the US housing market will continue to cool down, but the space may be limited.

Europe:

Market instability has been exacerbated by the war in Ukraine and high inflation, dampening the economy’s appetite for investing in new construction projects. According to Eurostat data, in December 2022, the output value of the construction industry in the euro zone fell by 2.5% month-on-month, reaching the largest decline in the past one and a half years. According to the forecast data released by Euroconstruct, the growth rate of European residential construction is expected to slow down significantly to 1.3% by 2024. This is the combined result of stagnant trends in new home construction and renovations (1.5% and 1.2%, respectively).

Car:

Automobile is another major downstream industry of MDI in Europe and America.

Europe: On January 18, 2023, the report released by the European Automobile Manufacturers Association showed that due to the continuous shortage of parts and components, the cumulative sales of cars in the EU region in 2022 will be 9.256 million, a year-on-year decrease of 4.6%. The sales have fallen to the lowest level since 1993 (accumulative sales of cars in the EU region in 1993 were about 9.2 million). According to Agence France-Presse, 2022 will be the third year that the European auto industry will experience difficulties. Affected by the new crown epidemic, a large number of factories and exhibition halls were closed, and the resulting supply bottlenecks, especially the shortage of key semiconductors, have not been alleviated after the epidemic has stabilized. Germany is the only major European auto market that will show growth in 2022. Car sales will increase by 1.1% year-on-year, while car sales in Italy, France and Spain will drop by 9.7%, 7.8% and 5.4% respectively.

Americas:

US: Production at many automakers will be hampered in 2022 by soaring material costs and persistent shortages of chips and other parts, according to industry consultant Cox Automotive. U.S. auto sales in 2022 are expected to be about 13.9 million, down 8% from 2021.

Brazil: In contrast, Brazil’s automobile production has performed relatively well. According to the Brazilian Automobile Manufacturers Association (Anfavea), by 2022…��The shortage of spare parts in Brazil’s auto manufacturing industry has improved significantly, driving the growth of auto production in the country. In addition, the increase in Brazilian auto exports to Latin American countries has also boosted the development of the country’s auto manufacturing industry. Brazil’s auto production is expected to reach 2.42 million units in 2023, an increase of 2.2%.

微信扫一扫打赏

微信扫一扫打赏