— Plans to invest in startups in five areas

— First investments made

Covestro is an investor in start-ups: through Covestro Venture Capital (COVeC) In this approach, the company hopes to align the needs of start-ups in terms of financing, expertise and network with its own strategic goals to ensure long-term sustainable development. Sucheta Govil, Chief Commercial Officer at Covestro, explains: “We are committed to innovation driven by sustainability. By collaborating with young companies, using their technologies and novel solutions, we will be able to take decisive steps forward. One step. This allows us to open up new business areas while delivering innovative solutions that give our customers a competitive advantage.”

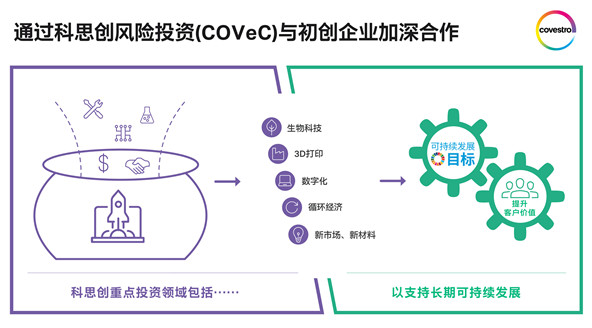

Deepen cooperation with start-ups through “Covestro Venture Capital” (COVeC)

Covestro’s investment in French start-up Crime Science Technology (C.S.T) is the latest example. With this investment, Covestro strengthens its specialty films business for security and identification applications, gaining exclusive access to optically variable film (O.V.M®) technology for polycarbonate and polyurethane materials. This innovative technology, developed by C.S.T, enables new security features to enhance the anti-counterfeiting performance of certificates.

Focus on established start-ups

Covestro’s research and development process is always based on the UN’s Sustainable Development Goals, so these goals play a crucial role in the selection of start-ups to invest in. To this end, COVeC has defined five key investment areas, which are: bio-based raw materials and biotechnology, additive manufacturing (such as: 3D printing), circular economy, digital technology, new markets and new technologies for existing core businesses.

When selecting start-ups, Covestro mainly focuses on companies in the A and B rounds of financing. Dietrich Firnhaber, Head of Strategy and Portfolio Development at Covestro: “Our investment focus is very clear: helping start-ups scale up during their growth phase rather than investing in entirely new ventures. To carry out all kinds of cooperation, we will adopt the effective open innovation approach.” Covestro plans to invest up to 5 million euros in the initial financing of a single project, and decide whether to participate in the follow-up project based on the situation of each project. financing. Funding projects must be approved by the board of directors. Currently, Covestro has no plans to set up a separate fund for venture capital.

Covestro made its first venture investment last year, buying a stake in the Series B round of German startup Hydrogenious LOHC Technologies GmbH. Covestro plans to cooperate with this young company to actively promote the construction of international hydrogen energy infrastructure and contribute to the development of alternative energy.

微信扫一扫打赏

微信扫一扫打赏