The construction industry is the main downstream industry of aggregated MDI in Europe, and the construction industry in Europe is closely related to the real estate industry.

Recent Situation of Real Estate in Europe

2021: European countries, such as Germany and the Netherlands, are benefited by low interest rates, monetary easing, and government stimulus measures in some countries. Local housing prices are rising, and real estate performance is healthy or even strong. In addition, aspects such as urbanization and household financial health are also boosting the development of European real estate and related construction industries.

Q1 2022: According to the “Global House Price Index Q1 2022” report released by internationally renowned real estate consultancy firm Knight Frank, analysis by world region (ignoring Turkey’s strong growth) shows that the average growth rate in North America (house prices) 18.6%, followed by Europe (11.6%) and Asia Pacific (6.4%).

It can be seen that in the first quarter of 2022, European real estate continued the strong momentum of 2021.

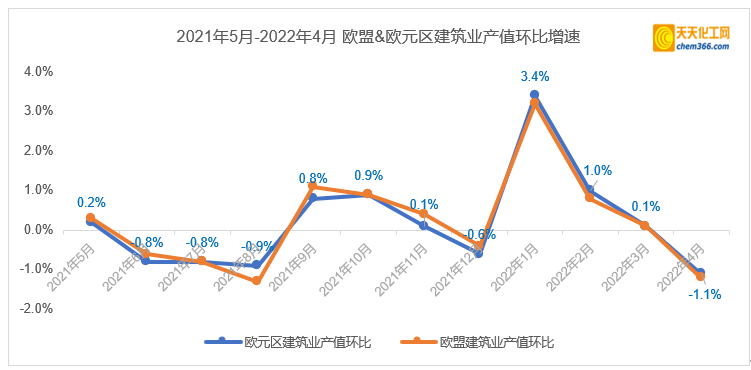

Recent Situation of European Construction Industry

According to the month-on-month growth rate data of the EU and Eurozone construction industry output value released by Eurostat in the latest year, in January 2022, the month-on-month growth rate of the European construction industry output value reached a nearly one-year high of 3.4%. From January to March 2022, the industry’s output value is positive month-on-month, which matches the above-mentioned continuation of the good momentum of European real estate development in the first quarter of 2022.

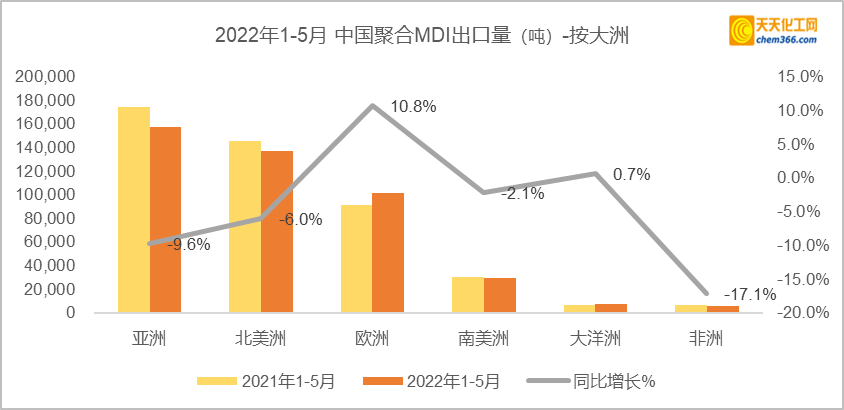

Export volume of polymerized MDI from China to Europe

From January to May 2022, China’s cumulative export volume of polymeric MDI was 439,000 tons. Among them, the weight of polymeric MDI exported to Europe increased by 10.8% year-on-year, which was higher than the overall level (-3.8%), and the weight of polymerized MDI exported to Europe accounted for about 23% of the total export volume.

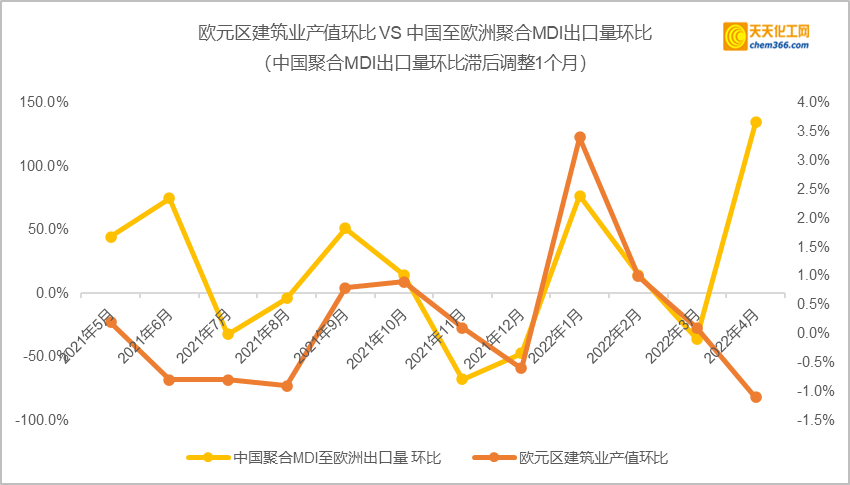

When we compare the export volume of China’s aggregated MDI to Europe in the last year with the output value of the construction industry in the euro zone, we can find from the figure below that the two are generally similar. However, the convergence was broken at the point in April 2022 (in March 2022, the export volume of China’s polymeric MDI increased by 134.5% month-on-month, and the output value of the construction industry in the euro zone decreased by 1.1% month-on-month in April 2022), showing a more obvious deviation trend.

Explanation 1: We choose the output value of the construction industry in the euro zone as a comparison instead of the output value of the construction industry in the EU, mainly because the countries in the euro zone are more relevant to the main export destinations of China’s aggregated MDI. Explanation 2: Considering the factor of the time difference of the shipping schedule, in this chart, we lagged the export volume of aggregated MDI by one month from the previous month.

Why is the month-on-month convergence between the output value of the construction industry in the euro zone and the export volume of China’s aggregated MDI broken in April 2022?

What impact will the situation in Russia and Ukraine, the problem of natural gas supply in Europe, and inflation have on the local downstream industries in Europe?

Is the North American construction industry data also converging with the export volume of China’s aggregated MDI?

In addition to the construction industry, what about the recent performance of downstream industries such as upholstered furniture and wood glue (furniture-related) in Europe and the United States?

…

Tonight (June 30) from 19:00 to 20:00, the cloud summit of “Changes in European and American Polyurethane Raw Material Markets Against the Background of Global Economic Turmoil” will share and communicate with you more exciting content.

微信扫一扫打赏

微信扫一扫打赏