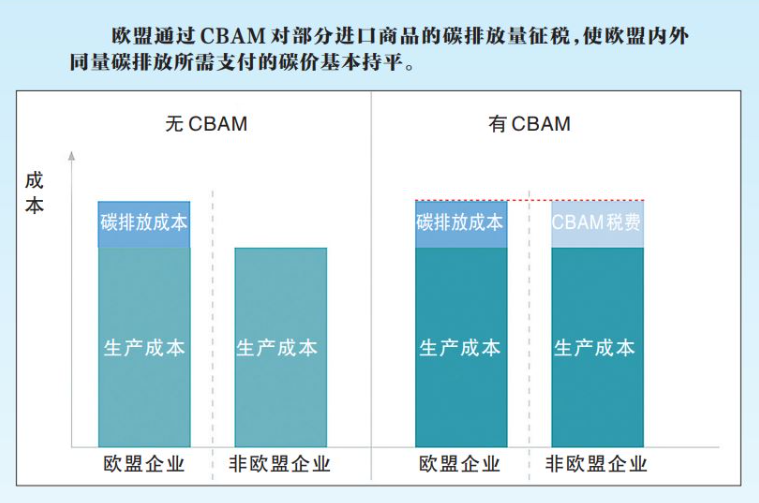

Starting from October 1, the EU Carbon Border Adjustment Mechanism (CBAM) will be put into trial operation, with a transition period until the end of 2025 and gradual full implementation from 2026 to 2034. According to CBAM, the EU will impose additional carbon border adjustment fees, known as “carbon tariffs”, on specific products such as cement, aluminum, fertilizers, and steel imported from abroad.

On September 14, at the regular press conference of the Ministry of Commerce of China, some media mentioned that although the EU stated that the purpose of the carbon border adjustment mechanism was to address global climate issues, some analysts believed that the EU’s move was to improve its products. Competitiveness. Regarding the fairness of carbon tariffs, there have been major disputes among industry organizations internationally and within the EU. First, the most-favored-nation principle of the World Trade Organization (WTO) states that similar products imported from different countries should not be subjected to discriminatory treatment. The principle of national treatment requires Imported and domestically produced similar products should not be treated differently, but the EU CBAM obviously treats products differently from the perspective of carbon emissions; secondly, according to the principle of “common but differentiated responsibilities” in international climate governance, different countries Different levels of carbon emission reduction responsibilities should be borne according to the actual situation of the country, but the EU CBAM transfers the cost of carbon emission reduction within the EU to developing countries in disguise. It is foreseeable that the implementation of EU CBAM will still face resistance from many parties in the future.

Eurostat data shows that in 2022, China will be the EU’s second largest trading partner, with EU-China trade volume reaching 856.3 billion euros, a year-on-year increase of 22.8%. Among them, the EU’s imports from China will be 626 billion euros, a year-on-year increase of 32.1%. Among the industries involved in CBAM, China’s organic chemicals, plastics and their products, steel and aluminum exports to the EU in 2022 will be 34.99 billion euros, 17.52 billion euros, 5.71 billion euros, and 5.33 billion euros respectively, accounting for a total of 30% of China’s total exports to the EU. About 10%.

In terms of export volume, in 2022, China’s steel and aluminum industries will export 3.599 million tons and 952,000 tons to the EU respectively, while the cement and fertilizer industries will export smaller amounts to the EU. In 2022, China’s organic chemicals and plastics and products industries’ exports to the EU will be 3.499 million tons and 4.285 million tons respectively.

Based on the carbon emission data of my country’s products (including electricity, transportation, etc.) and the EU average carbon price of 81 euros/ton in 2022, it is estimated that the carbon tariff that my country will need to pay for exporting products to the EU in 2022: plastics and their products amount to 2.7 billion euros, and organic Chemicals amounted to 2.75 billion euros, steel products amounted to 1.29 billion euros, aluminum products amounted to 1.2 billion euros, fertilizers, cement and ammonia exports were low, and carbon tariffs were relatively small.

According to a World Bank research report, if carbon tariffs are fully implemented, Chinese manufacturing may face an average tariff of 26% in the international market, and exports may fall by 21% as a result. The quantity of my country’s petroleum and petrochemical products exported to the EU is small, but the overall amount is not low. In particular, organic chemicals, plastics and their products that are included in the scope of taxation are greatly affected. Chemicals such as organic chemicals and plastics and their products are greatly affected. Regarding the organic chemicals, plastics and their products that are included in the scope of taxation, in terms of single varieties, my country’s exports to the EU are relatively small, but the export volume is relatively large. If the export of plastic products to the EU is restricted, it will in turn inevitably affect my country’s demand for upstream raw material synthetic resin, which will in turn affect the ethylene and oil refining industries.

The implementation of the EU’s carbon tariff policy will accelerate the evolution of the global trade pattern of petroleum and petrochemical products. The United States, the United Kingdom, Japan and other countries export a lot of chemicals and related products to the EU. After the EU CBAM is implemented in the future, these countries may turn to increase exports to China in order to avoid taxes, leading to intensified competition in my country’s domestic market.

The EU carbon tariff has set two carbon emission deduction situations. One is that EU importers can deduct the carbon emission credits that have been deducted for imported products in the country of production. The other is that they can refer to the free carbon emission credits obtained by EU companies with similar products. Reductions, however, will see free EU carbon emissions credits phased out in the future. Under the EU carbon tariff push, highly polluting industries such as power plants and industries will be allowed to purchase permits for the carbon emissions they produce. Free emission allowances provided to companies will be phased out in 2026, ending in 2034. Specifically, by 2026, 2.5% of the free quotas in these industries will be canceled, 5% in 2027, 10% in 2028, 22.5% in 2029, 48.5% in 2030, 61% in 2031, and 61% in 2032. 73.5% will be canceled, 86% will be canceled in 2033, and 100% will be canceled in 2034.

It is worth noting that the implementation of EU carbon tariffs will cause other developed economies to follow suit and launch their own carbon tariff policies. The United States is also an active practitioner of carbon tariffs and has been working hard to establish a U.S. carbon border adjustment mechanism. In early June 2022, the United States launched the Clean Competition Act, which will establish a carbon border adjustment mechanism as a trade tool to incentivize foreign producers to carry out deeper decarbonization and protect American companies. The bill covers 25 industries, including oil, natural gas, fertilizers, steel and other high-carbon-emitting industries. Canada, the United Kingdom and Japan are also actively waiting and watching. Japan proposed a “green growth strategy” at the end of 2020 and made it clear that it would consider cooperating with other countries to solve the problem of carbon leakage. In August 2021, Canada began to formally consult the public on carbon tariffs. The UK is discussing carbon tariff cooperation with the EU. The British government announced a series of environmental and energy security policies at the end of March this year, including an inquiry about the possible imposition of carbon tariffs on carbon-intensive goods.

As the globalization of carbon emissions issues continues to deepen, it is expected that the design of carbon trading mechanisms in various countries will converge, and the levels and trends of carbon prices in various regions will also tend to be consistent, showing the characteristics of global commodity price fluctuations. In 2022, the annual average transaction price in my country’s carbon market will be 55.3 yuan/ton, while the average carbon price in the European Union is 81 euros (approximately RMB 617)/ton, which is 11 times the carbon price in my country. It is expected that the EU carbon price will increase by 35% from 2025 to 2030. Based on this, it can be inferred that my country’s carbon emissions trading price will also show a rapid upward trend.

微信扫一扫打赏

微信扫一扫打赏