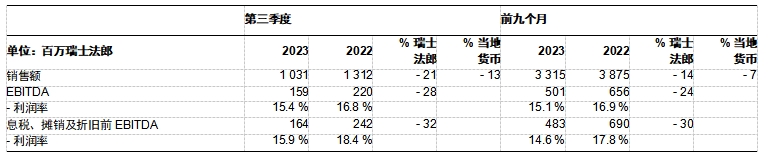

On October 30, Clariant released its third quarter financial report for 2023. In the third quarter, Clariant achieved organic sales of 1.031 billion Swiss francs (US$1.143 billion), a year-on-year decrease of 8% and a month-on-month increase of 2%; in terms of profit performance, the EBITDA profit margin in the third quarter dropped to 15.4%, while

In the third quarter of 2022, it was 16.8%, an increase of 340 basis points compared with the second quarter. Clariant’s sales from January to September totaled 3.315 billion Swiss francs (US$3.674 billion), a year-on-year decrease of 7%; the EBITDA profit margin dropped to 15.1%, compared with 16.9% in the first nine months of 2022.

Clariant CEO Conrad said, “Despite the continued uncertainty and risks related to the geopolitical and economic environment, our performance is improving. On a group basis, Clariant achieved basically consecutive quarterly EBITDA growth of 21%. Despite continued softness in demand for durable goods, which mainly impacted the Additives business, the group’s organic sales increased slightly compared to the previous quarter. Our proactive steps to adjust our cost base are improving profitability and we have delivered the savings we have committed to date. The target of CHF 170 million has been achieved by over CHF 120 million. This, together with our improved underlying performance, underpinned our strong cash generation in the third quarter. Additionally, we continue to see strong performance in the Catalysts business in terms of volumes and prices .Despite the continued weak economic environment and unfavorable exchange rate conditions, we expect

Results for 2023 will fall within our guidance range. Our focused specialty chemicals portfolio and highly engaged employees position us to grow profitably as end markets recover. ”

Clariant Performance in the Third Quarter

Sales in the third quarter of 2023 were CHF 1,031 million, with organic sales down 8%, down 13% in local currencies and down 21% in Swiss francs. Pricing fell by 3% year-on-year, and sales fell by 5% year-on-year. The revenue from the divestiture of the North American land oil and quaternary ammonium salt businesses was not enough to offset the expenditures for the acquisition of the US attapulgite business, and the product scope factor had a net negative effect of 5%.

Sales in the Care Chemicals business fell 18% in local currencies. Despite strong organic volume growth in the Oil Services business, sales in other business lines were below an extremely high comparable base in the third quarter of 2022. Catalysts sales increased 8% in local currencies, driven by the Propylene and Syngas & Fuels business lines, continuing the positive project execution of recent quarters. Adsorbents and Additives sales also came from a higher comparable base, falling 19% in local currency. In terms of the additive business, demand in major end markets remains challenging due to continued destocking.

In Europe, the Middle East and Africa, sales in local currencies fell 21%. Strong sales growth in the Catalysts business in the Middle East was only partially offset by lower sales in Care Chemicals (due in part to the divestment of the quaternary ammonium salts business) and in the Adsorbents and Additives business. In the Americas, sales fell 5% as lower sales in the Care Chemicals and Adsorbents & Additives businesses offset growth in Catalysts. Sales in the Asia-Pacific region fell by 12%, including a 2% decline in China.

Compared with the third quarter of 2022, group EBITDA fell by 28% to CHF 159 million, with an EBITDA margin of 15.4%. Currency Translation to EBITDA

There was a negative impact of 14%, while lower volumes affected production utilization in the Care Chemicals business and the Additives business. The sunliquid® business had a net negative impact on operations of

CHF 11 million (a year-on-year decrease of CHF 2 million). At the same time, the performance plan generated cost savings of CHF 14 million, addressing redundant costs from divestitures and making a positive contribution to offsetting inflation. Raw material costs also dropped 16% year-on-year.

Affected by exchange rate and product range factors, sales in the third quarter of 2023 decreased by 5% compared to the second quarter of 2023, to CHF 1.031 billion. Volumes improved slightly at group level, compensating for lower prices. Underlying profitability, reflected in EBITDA before special items, increased sequentially by 21% to CHF 164 million, implying a 340 basis point increase in margins to 15.9%. Proactive measures to adapt the cost base to the low-volume environment, strong operating performance in the Catalysts business and a small increase in organic sales in the Care Chemicals business all contributed to this significant improvement.

Clariant Performance in the First Nine Months

Sales in local currencies fell 7% to CHF 3,315 million in the first nine months of 2023 (organic sales 5%), with sales in Swiss francs down 14%. The product scope factor (acquired businesses partially offset divested businesses, but still a difference) was -2%. Sales volume fell 6%, but prices rose 1%.

Sales in the Care Chemicals business fell 12% in local currency. Strong organic growth (volume and price) in the Oil Services business was not enough to offset declines in other business lines, particularly the Crop Solutions business. Sales in the Catalysts business increased by 18%, with particularly strong growth in the propylene and syngas and fuels business lines. Sales in the Adsorbents and Additives business fell 12% in local currencies as continued weak demand for durable goods impacted additive sales.%.

Sales in local currencies declined in all geographic regions. This was most apparent in Europe, the Middle East and Africa, where sales fell 10% year-on-year. Sales in local currencies fell 5% in Asia Pacific and the Americas each

and 4%.

Group EBITDA fell by 24% to CHF 501 million, corresponding to a profit margin of 15.1%. The impact on profitability includes lower volumes and currency translation, a net impact of CHF 18 million from the sunliquid® business (including CHF 7 million in restructuring charges in the second quarter), and a CHF 11 million impact from the participation in the Heubach Group in the first quarter. Fair value adjustments in Swiss francs, and inventory depreciation. The positive earnings impact included an initial gain of CHF 62 million from the divestment of the care chemicals quaternary ammonium business, a 9% reduction in raw material costs, and cost savings of CHF 36 million due to the execution of a performance improvement plan.

ESG Update – Leading Sustainability

Over the past 12 months (September 2022 to September 2023), Clariant’s total Scope 1 and Scope 2 greenhouse gas emissions fell to 580,000 tons, a 6% decrease from the 620,000 tons emissions for the whole of 2022. Emissions from externally sourced goods and services (Scope 3) also fell by 13%, from 2.58 million tonnes in full year 2022 to 2.25 million tonnes in the past 12 months.

These results stem in part from lower volumes in the first nine months of 2023 and increased participation from Clariant’s sites and suppliers (Scope 3). This demonstrates Clariant’s continued progress towards achieving the Group’s 2030 emissions reduction targets.

Full Year Outlook for 2023

Clariant expects that the inflationary environment will ease in the last three months of 2023, but the economy will not recover and macroeconomic uncertainties and risks will still exist. Nonetheless, Clariant confirmed full-year sales guidance for 2023 of CHF 4.55-4.65 billion. This includes a net impact of approximately negative CHF 150 million from the divestitures/acquisitions of the quaternary ammonium, North American land oil and attapulgite businesses and is now expected to be at 5-10% of the previously announced

Negative exchange gain and loss effects of the upper range limit. Clariant also confirmed its reported full-year 2023 EBITDA guidance of CHF 650-700 million (reported EBITDA margin of 14.3%-15.1%), including CHF 62 million in initial proceeds from the sale of its quaternary ammonium salts business and the agreement Restructuring charges of CHF 30 million. Clariant expects the annualized negative impact on the sunliquid® business to be offset by cost savings resulting from the restructuring program.

Clariant is on track to achieve its sustainability goals. Clariant Group has become a true specialty chemicals company and remains committed to achieving its 2025 target of profitable sales growth (CAGR 4-6%), Group

EBITDA profit margin reaches 19-21%, and free cash flow conversion rate reaches approximately 40%.

微信扫一扫打赏

微信扫一扫打赏