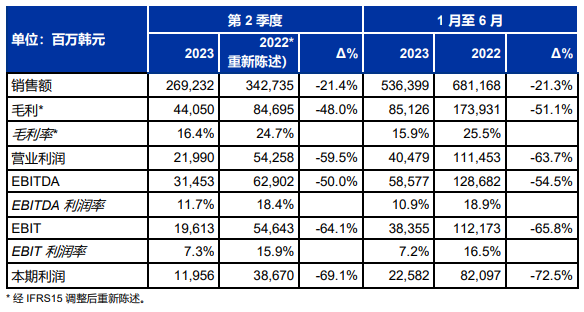

• 2Q23 consolidated sales total KRW 269.232 billion

• 2Q23 gross margin down 8.3 percentage points YoY

• 2Q23 net profit of KRW 11.956 billion

August 11, 2023 – SONGWON Industrial Group released its 2nd fiscal year 2023

Quarterly and semi-annual financial performance reports. In the second quarter, the group achieved consolidated sales of KRW 269.232 billion, representing a year-on-year decrease of 21.4% (Q2 2022: KRW 3,427.35

billion won). Year-to-date, the group has achieved consolidated sales of KRW 536.399 billion, down 21.3% from the same period last year (January-June 2022: 6,811.68

billion won), net profit fell to 22.582 billion won (Q2 2022: 82.097 billion won). In Q2 2023, the Group achieves 16.4%

Gross profit margin, year-to-date gross profit margin was 15.9%, down 8.3 percentage points and 9.6 percentage points from the same period last year

As expected, Q2 2023 continued in Q1 2023 with geopolitical tensions, a volatile economic environment and lower demand across regions, which impacted SONGWON

The performance of each department.

Due to the challenging market environment, aggressive pricing strategies and fierce competition, coupled with low demand, lack of reliable customer forecasts and short-term foresight, the Chemical Materials Division’s 2023 No. 2

Quarterly performance was poor. The segment recorded revenue of KRW 198.774 billion in 2Q23, down 23.7% YoY (2Q22: 2,604.06

billion won). From January to June 2023, the division achieved sales of 394.721 billion won, down 22.5% year-on-year (January-June 2022: 5,092.71

billion won).

In Q2 2023, increased product availability, intense price competition (mainly originating in Asia) and the ongoing Russia-Ukraine conflict negatively impacted the Polymer Stabilizers business. However, overall performance was stable, with

Flat in 1Q23.

In the second quarter of 2023, the market demand for fuel and lubricant additives is similar to that in the first quarter of 2023, and the sales volume is also the same as in the first quarter of 2023

Quarterly flat. Revenue was negatively impacted by lower raw material and freight costs due to the previously implemented raw material pricing mechanism. The coatings business grew slowly in 2Q due to oversupply in the market. This results in prices lower than 2023

Further declines in 1Q19, in addition to increased price erosion due to lower raw material prices.

The performance of the Performance Chemicals segment in the second quarter was unchanged from the previous quarter, with no significant changes. The segment recorded revenue of 70.458 billion won in 2Q23, down year-on-year

14.4% (Q2 2022: KRW 82.329 billion). Year-to-date, the division achieved sales of KRW 141.678 billion, down from the same fiscal period in 2022

17.6% (January to June 2022: 171.897 billion won).

2nd of 2023

During the quarter, tin intermediates saw slight improvements in turnover, volume and margins, benefiting from higher prices for tin metal and final products, as well as signs of recovery in the automotive markets in China and Europe. As the Asian market has not yet seen a recovery, PVC

Market weakness continued, but sales outside Asia had a positive impact on profitability. Stable raw material prices for solution polyurethane and thermoplastic polyurethane in 2023 2nd

Quarterly profitability provided support, but the ongoing recession negatively impacted customers’ business operations, with stagnant demand in South Korea leading to continued intense competition.

2023 will be a challenging year for the industry in the face of continued geopolitical uncertainty, inflationary pressures, and a low-visibility macroeconomic environment. Entry 2023 3rd

On the occasion of the quarter, SONGWON

Demand is expected to remain weak, with further declines in raw material and logistics prices. Nevertheless, the Group is optimistic about the effectiveness of its response to market imbalances and the positive impact of new products on future revenue and profitability. SONGWON

It will continue to pursue its strategy, focusing on global trends and prioritizing customer needs. Looking ahead to the next six months, the company is cautious and confident in its ability to meet emerging challenges and remain a reliable supplier to customers.

微信扫一扫打赏

微信扫一扫打赏