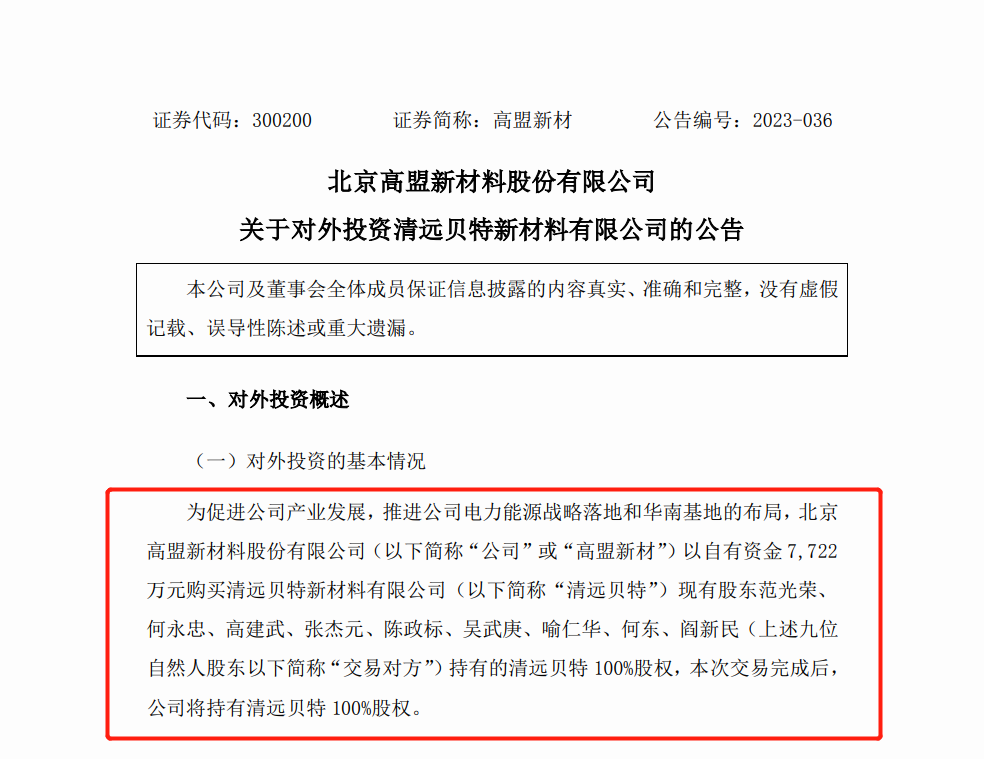

On August 4th, Beijing Gaomeng New Materials Co., Ltd. (hereinafter referred to as “Gaomeng New Materials”) released the “Beijing Gaomeng New Materials Co., Ltd. on foreign investment in Qingyuan Better New Materials Co., Ltd. Company Announcement”. According to the announcement, in order to promote the company’s industrial development, promote the implementation of the company’s power energy strategy and the layout of the South China base, Gaomeng New Materials purchased Qingyuan Better New Materials Co., Ltd. (hereinafter referred to as “Qingyuan Better”) with its own funds of 77.22 million yuan.

After the completion of this transaction, Gaomeng New Material will hold 100% equity of Qingyuan Better.

The announcement disclosed the investment purpose of Gaomeng New Materials. Qingyuan Better has high brand awareness, research and development capabilities and product competitiveness in the field of insulating potting resins. It has strong innovation in technology development and its products are widely used in automotive motors. , traction motors, industrial motors, special motors, reactors, transformers, capacitors and other fields, customers include well-known manufacturers in related fields, and the products have high bargaining power and market competitiveness.

It is worth noting that Gaomeng New Materials also issued an announcement at the same time, saying that the company plans to increase the capital of Chengdu Yuehai Gold Semiconductor Materials Co., Ltd. (“Chengdu Yuehai Gold”) with 50 million yuan. After the capital increase, Gaomeng New Materials Will hold 4.2735% equity of Chengdu GDH. The main products of Chengdu Yuehai Gold include 6-inch conductive silicon carbide substrate wafers and 4/6-inch high-purity semi-insulating silicon carbide substrate wafers. Investing in Chengdu GDH is conducive to expanding the company’s development direction and exploring development opportunities in the field of new semiconductor materials.

Before the acquisition, Qingyuan Better’s corporate development was actually not optimistic. The main financial data of Qingyuan Better in 2021, 2022 and January-March 2023 disclosed in the report show that during the reporting period, Qingyuan Better achieved operating income of 141 million yuan, 119 million yuan and 24 million yuan respectively; The profit was 1,259,100 yuan, 3,719,200 yuan, and -282,500 yuan, all financial data showed a sharp decline, and there was even a loss last year.

In this regard, Gaomeng New Materials stated that Qingyuan Better’s business and products are highly synergistic and complementary to the company. By leveraging the advantages of both parties, Gaomeng New Materials’ market share in the field of electric energy can be further expanded and products application. At the same time, Qingyuan Better is located in Guangdong. The company will rely on Qingyuan Better to plan and build Gaomeng New Materials South China New Material Industry Base in the future, which can further expand the layout of Gaomeng New Materials in the South China market.

It is not difficult to see from the recent series of actions of Gaomeng New Materials that enterprises are gradually making efforts to increase the company’s production capacity, further expand emerging development directions, enrich and optimize product structure, which is not unrelated to the slowdown of Gaomeng New Materials’ development in recent years.

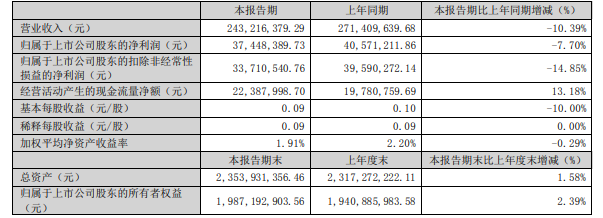

According to the first quarter report of 2023 disclosed by Gaomeng New Materials in April. During the reporting period, the company achieved a total operating income of 243 million yuan, a year-on-year decrease of 10.39%; net profit attributable to the parent company was 37.4484 million yuan, a year-on-year decrease of 7.70%; non-net profit was 33.7105 million yuan, a year-on-year decrease of 14.85%. The analysis of relevant authoritative organizations has pointed out that the development stability of Gaomeng New Materials has been average in the past ten years, and the non-net profit has been negative growth all year round. In the long run, the profitability is average.

According to the data, the main business of Gaomeng New Materials is divided into three categories, namely adhesive material business, NVH sound insulation and vibration reduction materials, and environmental protection coating resin. Among them, the adhesive material business and NVH sound insulation, vibration and noise reduction materials are its traditional core businesses, and the environmental protection coating resin business is acquired by holding Jiangsu Ruipu Resin Technology Co., Ltd. (hereinafter referred to as “Jiangsu Ruipu”) through capital increase.

According to the data, Jiangsu Ruipu focuses on the R&D, production and sales of high-performance and high-quality powder coating resins, UV coating resins and water-based UV resins, especially low-temperature powder coating resins and water-based UV coating resins. The main application market of the products is industrial coatings , construction machinery, transportation, construction, wood, ink and electronics and other fields. Jiangsu Ruipu has a team of senior experts from industry-leading companies, and has a complete powder resin, UV and water-based UV production process system, especially in the development and application of low-temperature powder resin. It has reached the industry-leading level and is becoming the industry leader in low-temperature powder resin Benchmark enterprise.

In recent years, Gaomeng New Materials has continuously deepened its layout in the automotive sector. As an important pillar industry of the national economy, the automobile has a sustainable development space, and Gaomeng New Materials is constantly moving around the automobile industry. The acquisition of Qingyuan Bite this time can be regarded as one of its measures to expand to the upstream and downstream, enrich product categories horizontally and expand application fields.

微信扫一扫打赏

微信扫一扫打赏