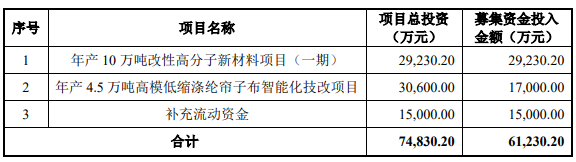

Recently, Haiyang Technology Co., Ltd. (hereinafter referred to as “Haiyang Technology”) submitted the prospectus (declaration draft) for its initial public offering and listing on the main board. This time, no more than 45.3129 million shares are planned to be issued on the main board of the Shanghai Stock Exchange. This issuance does not involve shareholders’ public offering of shares. The funds raised this time will be used for the project with an annual output of 100,000 tons of modified polymer new materials (Phase I), an annual output of 45,000 tons of high-modulus low-shrinkage polyester cord fabric intelligent technical transformation projects and supplementary working capital. The investment amount of the raised funds It is expected to be 612 million yuan.

According to public information, Haiyang Technology is a high-tech enterprise that develops and produces nylon 6 series products, and has formed a complete nylon 6 series product system integrating slices, silk threads and cord fabrics.

In terms of performance, from 2020 to 2022, Haiyang Technology will achieve operating income of 2.759 billion yuan, 3.947 billion yuan, and 4.067 billion yuan; realize net profits attributable to the parent company of 34.0106 million yuan, 277 million yuan, and 154 million yuan, respectively.

The products and technical strength of Haiyang Technology have been recognized by well-known customers at home and abroad. Up to now, Haiyang Technology has cooperated with BASF, DSM, Lanxess, Kingfa Technology, Huading, Aifeier, Zhengxin Group, Zhongce Rubber, Linglong Tire, Sentury and other well-known large-scale chemical, chemical fiber, and tire companies at home and abroad have carried out long-term cooperation in the issuer’s main product fields.

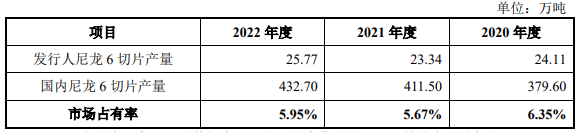

In terms of market share, based on the output of nylon 6 series products, from 2020 to 2022, Haiyang Technology’s share in the domestic nylon 6 chip market will be about 6%.

微信扫一扫打赏

微信扫一扫打赏