According to Reuters news, 3M (MMM.US) said in its latest first-quarter financial report that it plans to lay off 6,000 people, which is the latest move by the company to deal with the decline in demand in several key markets. move. 3M said the layoffs are part of a broader restructuring plan that is expected to cut annual costs by as much as $900 million. Its chief executive said the layoffs would involve all functions, businesses and regions of the company.

Previously, 3M announced in January that it would lay off 2,500 people in response to weak demand. 3M CEO Mike

These moves “will reduce the company’s core costs, further simplify and strengthen our supply chain structure, and simplify our go-to-market business model, which will improve margins and cash flow,” Roman said in its first-quarter earnings report.

Sales performance continued to decline, falling into “survival crisis”

According to the financial report, 3M

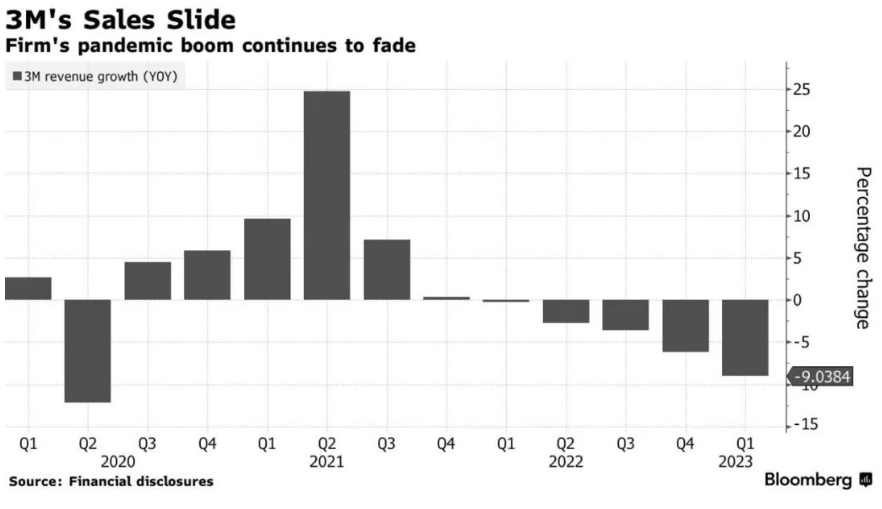

Q1 sales fell 9.0% year-on-year to $8.03 billion, higher than market expectations of $7.51 billion; adjusted sales fell 9.7% year-on-year to $7.7 billion. Adjusted earnings per share came in at $1.97, beating consensus estimates of $1.60 and compared with $2.63 a year earlier.

Judging from the sales performance of 3M in recent years, starting from Q3 in 2021, 3M’s sales performance has continued to decline. The chemical giant is struggling to shake off weak demand for consumer goods, electronics and about 60,000 other products.

From the changes in the market value of 3M in the past three years, it can be seen intuitively that since July 2021, the market value of 3M has been declining, from 120 billion to the current 55 billion.

Analysts said 3M shares fell 14% in the first quarter, making them the biggest decliners on the Dow Jones Industrial Average.

More foreign media said that due to the continuous decline in revenue, 3M’s stock trading price has fallen to its lowest level in a decade. Until the end of this year, the decline is difficult to improve. 3M expects sales to fall between 2% and 6% this year, with adjusted earnings about 10% below 2022 levels.

Analysis of the reasons for the decline in performance

Founded in 1902, 3M is an American multinational enterprise group, and the well-known N95 mask was developed by this company.

From the perspective of products, after gradually getting out of the epidemic, people’s demand for masks has dropped sharply. The company’s backlog of orders has been shipped, and so many employees are no longer needed to handle the workload. 3M’s supply chain problems have basically eased.

From the market point of view, in 2022, 3M announced its withdrawal from the Russian market, so the closure of related regional businesses will inevitably affect the employment plan.

In this regard, in order to open up new growth points, 3M plans to shift its focus to high-growth businesses in the future, including automotive electrification and home improvement, and give priority to emerging growth areas such as climate technology and next-generation consumer electronics. One of the reasons for the implementation of the plan.

in crisis

Deane, Analyst, RBC Capital Markets

Dray said in a telephone interview with foreign media: “3M stock is currently not investable. This year will be a very difficult year for the company.” He said that the risk of litigation is the biggest threat facing 3M.

The 3M earbuds division previously faced claims from more than 290,000 active and ex-servicemen for producing earplugs for the U.S. military (claiming that their earplugs were defective and damaged their hearing), as well as the so-called permanent chemical (PFAS) – polyfluorothane The pollution problem of base materials (companies such as 3M and DuPont (DD.US), Chemours (CC.US) are all considered to be one of the manufacturers of such pollutants), the company may face billions of dollars in potential liabilities .

微信扫一扫打赏

微信扫一扫打赏