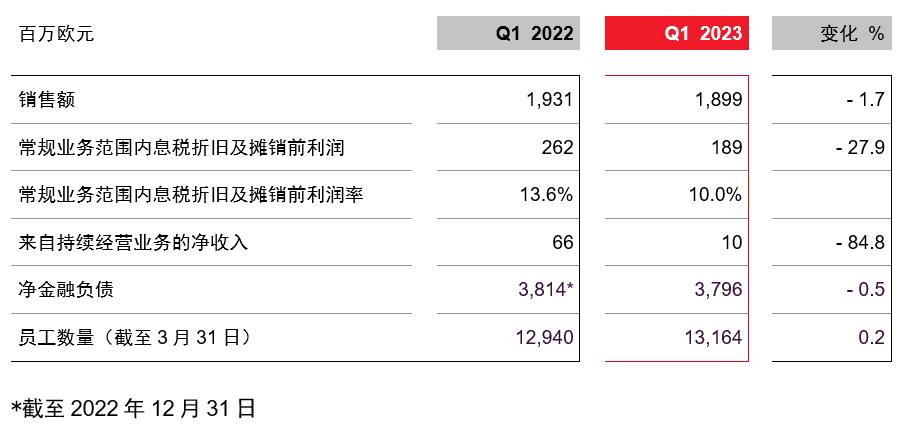

● Sales were largely stable at EUR 1,899 million (-1.7%)

● EBITDA pre exceptionals was EUR 189 million, down 27.9% year-on-year

● Consumer Protection grew sales and earnings

● Free cash flow of EUR 112 million was significantly higher than in the prior-year period

● Full-year guidance for 2023: EBITDA pre exceptionals of EUR 850 million to EUR 950 million

Specialty chemicals company LANXESS delivered its earnings forecast for the first quarter of 2023: EBITDA previo was 189 million euros, within the range of 180 million to 220 million euros forecast in March. Compared with the 262 million euros in the same period of the previous year, the income decreased by 27.9%. Sales remained basically stable at 1.899 billion euros, only 1.7% lower than the 1.931 billion euros in the same period last year.

In particular, weaker demand from some customers’ industries, notably construction, and continued inventory reductions at many customers weighed on earnings. This is particularly evident in the High Quality Intermediates and Specialty Additives business segment. In contrast, the Consumer Protection business segment performed strongly, increasing sales and earnings despite a slight decline in volume. The acquisition of the microbiological control business from the US company IFF in mid-2022 played a particularly positive role. LANXESS once again managed to pass on rising raw material and energy costs, and all its business segments also benefited from the positive currency impact.

Free cash flow increased significantly by EUR 264 million year-on-year to EUR 112 million. This is supported by stable working capital, although there is also a seasonal growth factor. In the first quarter, net income from continuing operations was 10 million euros, down from 66 million euros a year earlier. The EBITDA margin pre exceptionals was 10.0 percent, down from 13.6 percent in the prior-year quarter.

Chang Mutian, CEO of Lanxess said: “Unsurprisingly, 2023 will be a difficult year for the chemical industry and for Lanxess. Our first quarter figures show this very clearly. Therefore, we press The planned transfer of the High Performance Plastics business to a joint venture on April 1 takes on added importance. This has enabled us to shift our portfolio further towards specialty chemicals and improve our financial position. This will put us in the current predicament more resilient. However, I expect economic conditions to improve significantly in the second half of the year, which will also be reflected in our earnings.”

For the coming months, LANXESS expects a challenging economic environment that will remain highly uncertain. LANXESS therefore expects earnings in the second quarter of 2023 to be roughly in line with the first quarter. For the second half of the year, LANXESS expects a clear recovery in earnings, given the recovery of the global economy and especially the positive developments in the Chinese market. Against this backdrop, LANXESS expects EBITDA pre-runs to be in the range of 850 million to 950 million euros for the full fiscal year 2023.

Increased focus on specialty chemicals

LANXESS continues to focus on specialty chemicals and will transfer the High Performance Materials (HPM) business unit to a joint venture with private equity investor Advent Capital on April 1, 2023. The High Performance Engineering Polymers joint venture, called Envalior, includes HPM (High Performance Materials) and DSM’s Original Engineered Materials business. Lanxess owns about 40 percent of Envalior, and Advent Capital owns about 60 percent. As part of the transaction, LANXESS received a payment of approximately EUR 1.27 billion from Advent on March 31. LANXESS will primarily use this amount to reduce debt and improve its financial position.

Business Segments: Strong Performance in Consumer Protection

In the first quarter, sales in the Consumer Protection segment amounted to 647 million euros, 27.9 percent higher than the 506 million euros in the same period of the previous year. EBITDA pre exceptionals amounted to 94 million euros, 9.3 percent higher than the 86 million euros in the same period of the previous year. The Microbial Control business acquired from IFF Corporation in July 2022 makes a particular contribution to the segment. All business units in the segment also achieved higher selling prices. However, lower volumes and delivery problems with one supplier negatively impacted earnings. The segment’s EBITDA margin pre exceptionals was 14.5 percent, down from 17.0 percent in the prior-year period.

Compared with the strong performance in the first quarter of the previous year, sales in the Specialty Additives segment fell by 9% from 730 million euros to 664 million euros. EBITDA pre exceptionals fell by 27.9 percent from 136 million euros to 98 million euros. Earnings have been hit particularly hard by weak demand in the construction and auto sectors. Sales volumes in all business units in the segment were below the prior-year level. A weather shutdown at a U.S. production plant, coupled with higher freight rates, also contributed to the drop in earnings. The segment’s EBITDA margin pre exceptionals was 14.8 percent, down from 18.6 percent in the prior-year quarter.

Weaker demand, especially from the construction and chemical industries, and lower volumes had a negative impact on sales and earnings in the High Quality Intermediates segment. Sales of the business segment in the first quarter were 516 million euros, 15.8 percent lower than the 613 million euros in the same period of the previous year. At EUR 44 million, EBITDA pre exceptionals was 49.4 percent below the EUR 87 million figure in the prior-year quarter. The EBITDA margin pre exceptionals was 8.5 percent, down from 14.2 percent in the prior-year quarter.

微信扫一扫打赏

微信扫一扫打赏