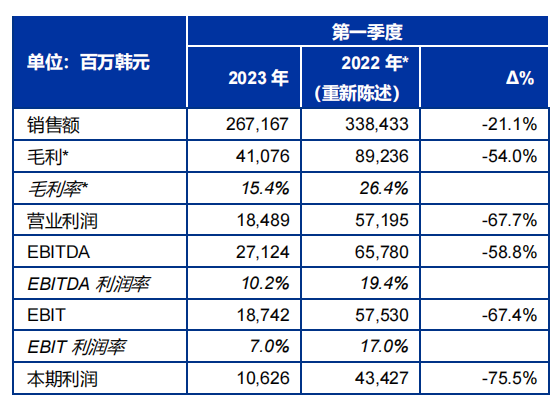

Recently, Songwon Group (SONGWON) released its audited financial performance report for the first quarter of 2023. The group reported a year-on-year decline of 21.1% in sales in the first quarter of 2023, from KRW 338.433 billion (US$256 million) in the first quarter of 2022 and KRW 267.167 billion (US$202 million) in the first quarter of 2023. In the first three months of 2023, Songwon’s gross profit margin was 15.4%, down 11% compared to the same period last year (26.4%). Net profit in the first quarter of 2023 was 10.626 billion won ($8.03 million), down from 2022

43.427 billion won ($32.82 million) in the first quarter of 2019.

In fiscal year 2022, Songwon Group has achieved good financial performance, but due to the expected further decline in demand, starting in 2023, the earnings achieved will slowly decline. Throughout the first quarter of 2023, both the Chemicals Ingredients and Performance Chemicals segments were impacted by ongoing geopolitical tensions, deteriorating economic conditions and inflationary pressures, in addition to customer destocking activities. As a result, the chemical raw materials division posted sales of 195.947 billion won in the first three months of this year, down 21.3% from 248.865 billion won in the first quarter of 2022. Likewise, the performance chemicals segment’s consolidated sales were 71.220 billion won, down 20.5% from 89.568 billion won in the first quarter of 2022.

As expected, the first quarter of 2023 will be a major challenge for Songwon Group’s polymer stabilizer business. Weak demand, mainly negatively impacted by the Russia-Ukraine conflict and intense price competition in Asia, led to a significant decline in revenue. Fuels and Lubricants performed well in the first quarter of 2023 with higher revenues due to the effective implementation of pricing mechanisms. The business also benefits from lower raw material and transportation costs. Songwon’s coatings business was negatively impacted by weak demand and price erosion in the first quarter due to increasing supply levels in the market.

Compared to 2022, the sales volume of the tin intermediate business in the first quarter of 2023 has decreased, and at the same time, due to the continuous fluctuation of tin prices, the profit margin has fluctuated strongly. However, as the Chinese market gradually improves, revenue is expected to increase in the next quarter. For PVC, the first quarter of 2023 is very challenging, mainly due to the stagnation of the construction industry in South Korea and the resulting weak demand, as well as the Lunar New Year holiday. Volumes of solution polyurethane and thermoplastic polyurethane were slightly higher than in the fourth quarter of 2022 due to stable pricing and lower raw material costs. In addition, profitability in the first quarter is also higher than in the fourth quarter of 2022.

However, 2023 is expected to be a challenging year as the current macroeconomic environment continues to be volatile and complex. Therefore, Songwon Group will not make any predictions on the market development, but will pay close attention to the future development trend. The Group will continue to execute its existing strategy and implement appropriate measures to ensure that its operations and business can adapt to the changing market environment. Looking to the future, Songwon Group is confident to meet the current challenges and be ready to meet customer needs and ensure long-term sustainable growth.

微信扫一扫打赏

微信扫一扫打赏