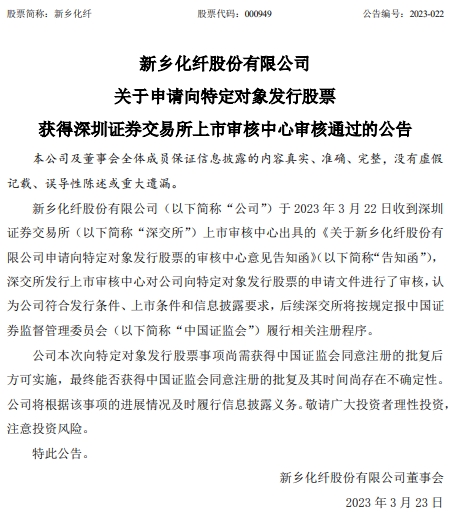

Xinxiang Chemical Fiber recently issued an announcement stating that the company received the “Notification Letter of Review Center Opinion on Xinxiang Chemical Fiber Co., Ltd.’s Application to Issue Stocks to Specific Objects” issued by the Shenzhen Stock Exchange Listing Review Center on March 22, 2023 (hereinafter referred to as the “Notification Letter”), the Issuance and Listing Review Center of the Shenzhen Stock Exchange has reviewed the company’s application documents for issuing stocks to specific targets, and believes that the company meets the requirements for issuance, listing and information disclosure, and the Shenzhen Stock Exchange will follow up. The China Securities Regulatory Commission performs relevant registration procedures.

On March 21, 2023, Xinxiang Chemical Fiber released the 2022 stock issuance prospectus (revised draft) to specific targets. The total funds to be raised by the company’s issuance of stocks to specific targets is expected to be no more than 1.38 billion yuan (including the original amount), after deducting the issuance expenses The net raised funds will be used for the third phase of the project with an annual output of 100,000 tons of high-quality ultra-fine denier spandex fiber, the project with an annual output of 10,000 tons of biomass cellulose fiber, and supplementary working capital.

Xinxiang Chemical Fiber’s issuance of shares to specific targets is no more than 35 (including 35) specific targets that meet the conditions stipulated by the China Securities Regulatory Commission, including securities investment fund management companies, securities companies, and financial companies that meet the requirements of the China Securities Regulatory Commission. , insurance institutional investors, trust companies, qualified foreign institutional investors, RMB qualified foreign institutional investors and other qualified investors. Securities investment fund management companies, securities companies, qualified foreign institutional investors, and RMB qualified foreign institutional investors who subscribe for two or more products under their management are regarded as one issuer; Fund subscription.

The target of this issue of Xinxiang Chemical Fiber has not yet been determined. The final target of the issuance will be approved by the Shenzhen Stock Exchange and registered by the China Securities Regulatory Commission. The provisions of departmental regulations or normative documents shall be determined according to the purchase quotations of the issuers.

The pricing base date of Xinxiang Chemical Fiber’s stock issuance to specific targets is the first day of the company’s issuance period. The issue price of this issuance shall not be lower than 80% of the average trading price of the company’s stocks in the 20 trading days before the pricing base date (excluding the pricing base date, the same below) and the company’s latest audited net asset value per share before the issuance. whichever is higher (i.e. the “floor price”). The average price of the company’s stock trading in the 20 trading days before the pricing base date = the company’s total stock trading volume in the 20 trading days before the pricing base day ÷ the company’s total stock trading volume in the 20 trading days before the pricing base day.

The number of shares proposed to be issued by Xinxiang Chemical Fiber to specific targets this time does not exceed 300 million shares (including the original number), accounting for 20.45% of the company’s total share capital before this issuance, and does not exceed 30% of the company’s total share capital before this issuance.

As of the signing date of the above-mentioned prospectus, Bailu Group holds 442,507,079 shares of the company, accounting for 30.17% of the company’s total share capital, and is the company’s direct controlling shareholder; Xinxiang State-owned Assets Group indirectly holds the company’s equity through Bailu Group, and is the company’s indirect controlling shareholder; Xinxiang The Municipal Finance Bureau indirectly holds equity in the company through Xinxiang State-owned Assets Group and Bailu Group, and is the actual controller of the company.

The number of shares to be issued this time shall not exceed 300 million shares (including the original number). According to the calculation of the upper limit of the number of shares issued this time, after the completion of this issuance, Bailu Group will still be the company’s direct controlling shareholder, Xinxiang State-owned Assets Group will still be the company’s indirect controlling shareholder, and Xinxiang City Finance Bureau will still be the company’s actual controller. There will be no change in control of the company.

In addition, the company will reasonably determine the upper limit of subscription for a single investor and its concerted actors in combination with the final number of issued shares at the issuance stage to ensure the stability of the company’s control after the issuance.

Therefore, the offering will not result in a change in control of the company.

The issuance sponsorship letter (revised draft) of Ping An Securities Co., Ltd. issued by Xinxiang Chemical Fiber Co., Ltd. on the issuance of shares to specific objects in 2022 by Xinxiang Chemical Fiber Co., Ltd. on March 21, 2023 shows that the company’s sponsor for the issuance of stocks to specific objects ( The lead underwriter) is Ping An Securities Co., Ltd., and the sponsor representatives are Zhou Xie and Yang Huiyuan.

微信扫一扫打赏

微信扫一扫打赏