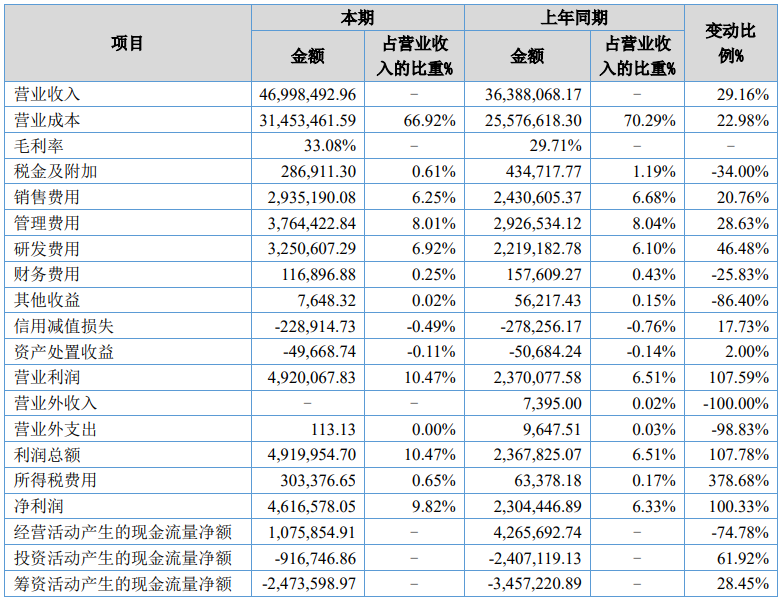

On August 7, the New Third Board Double Bond New Materials released the 2023 semi-annual performance report.

1. The operating income for the current period was 46,998,492.96 yuan, an increase of 29.16% from the 36,388,068.17 yuan from January to June 2022. The main reason is that the company insists on being market-oriented and providing customers with product customization services. Relying on advanced production technology, stable quality control capabilities, and a marketing service system focusing on long-term strategic cooperation, the company enjoys a high reputation in the domestic market and has obvious competitive advantages, which will enable the company to achieve a relatively large overall growth in main business income in 2022 ;

2. The operating cost for the current period is 31,453,461.59 yuan, an increase of 22.98% compared with 25,576,618.30 yuan from January to June 2022, mainly due to the increase in carry-forward costs brought about by the increase in business scale and income;

3. R&D expenses for the current period are 3,250,607.29 yuan, an increase of 46.48% compared with 2,219,182.78 yuan from January to June 2022, mainly due to the increase in R&D projects in the first half of 2023, resulting in an increase in R&D investment in the current period;

4. The operating profit, total profit, and net profit of the current period increased by 107.59%, 107.78%, and 100.33% respectively compared with the same period last year, mainly because the increase in revenue scale and gross profit margin brought about an increase in gross profit, which led to an increase in operating profit, total profit, and net profit due to. the

5. During the reporting period, the net cash flow from operating activities decreased by 3,189,837.83 yuan compared with the net cash flow from operating activities in the same period of the previous year, a decrease of 74.78%, mainly due to the substantial increase in cash paid for purchasing goods and receiving labor services during the reporting period. To;

6. During the reporting period, the net cash flow from investment activities increased by RMB 1,490,372.27 or 61.92% compared with the net cash flow from investment activities in the same period of the previous year. Mainly due to the decrease in cash paid by the company for the purchase and construction of fixed assets and other long-term assets in the current period compared with the same period of the previous year;

7. During the reporting period, the net cash flow from financing activities increased by RMB 983,621.92 or 28.45% over the same period of the previous year. The main reason is that the company’s current debt repayment decreased compared with the same period of last year.

微信扫一扫打赏

微信扫一扫打赏