On July 6, the trade war between China and the United States, the world’s top two economies, officially started, and the Sino-US trade war has intensified since then.

On July 11, 2018, the U.S. government announced that it would impose a 10% tariff on about US$200 billion of goods imported from China, and on August 2, the tariff rate would be increased to 25%. On September 18, 2018, the U.S. government announced the implementation of measures to impose tariffs on approximately US$200 billion of goods imported from China. The tariff rate will be 10% from September 24, 2018, and will start from January 1, 2019. The tariff rate was increased to 25%.

On September 18, 2018, according to the “Announcement of the Customs Tariff Commission of the State Council on Imposing Additional Tariffs on Some Imported Commodities Originating in the United States (Second Batch)” (Tax Commission Announcement [2018] No. 6), since Additional tariffs will be imposed at 12:01 on September 24, 2018, and 10% tariffs will be imposed on 2493 tax items listed in Annex 1, 1078 tax items listed in Annex 2, and 974 tax items listed in Annex 3. Commodities and 662 tax items listed in Annex 4 are subject to a 5% tariff.

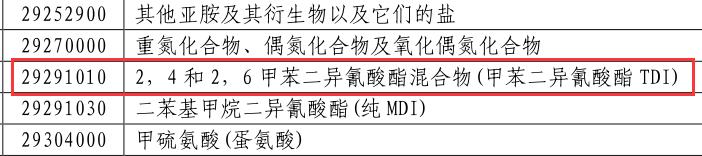

Figure 1: China’s list of goods subject to additional tariffs on the United States

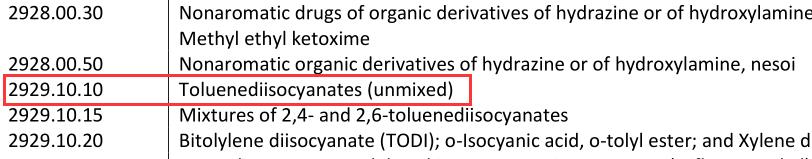

Figure 2: The list of 200 billion imposed by the United States on China

In the tariff rate adjustment list of imported goods between China and the United States (as shown above), toluene diisocyanate (TDI) under the tariff number 29291010 Products are also listed among them. Below, the editor of Tiantian Chemical Network briefly analyzes the impact of taxation on China’s TDI import and export.

From the point of view of import

According to the data of Tiantian Chemical Network, there were 11 sources of China’s imports in 2017, with an import volume of 42,800 tons. The main import source countries are South Korea and Japan, the import volume is about 28,600 tons and 8,200 tons respectively, and the import volume of South Korea and Japan accounts for TDI 86% of total imports. In 2017, China’s total import of TDI from the United States was 33 tons, accounting for 0.08% of the total import volume. It can be seen that the import from the United States Therefore, China imposes a 10% tariff on TDI from the United States, and domestic TDI has limited import impact.

Table 1: Import volume of some regions of TDI in China in 2017 (unit: tons)

region | South Korea | Japan |

Import weight | 28611 | 8220 |

From the exit

In 2017, China’s TDI exports involved 77 regions, with a total export volume of 124,100 tons. Among them, the volume exported to the United States ranked first, about 13,000 tons, accounting for about 10.6% of China’s total TDI exports.

From the perspective of China’s major exporters, according to the data of Tiantian Chemical Network, the supplier that exported to the United States in 2017 was basically Covestro, and other manufacturers did not export to the United States. Covestro’s TDI The export volume is about 13,000 tons, accounting for 13.2% of its total export volume. It can be seen that the export volume of the United States still has a certain share. Therefore, the United States has imposed tariffs on TDI from China (since 2018 The tariff rate will be 10% from September 24th, and the tariff rate will be increased to 25% from January 1st, 2019), for domestic TDI Export volume will be affected to a certain extent.

Table 2: The export volume of some regions of TDI in China in 2017 (unit: tons)

region | United States | Germany | China Taiwan | India |

region | United States | Germany | China Taiwan | India |

Export weight | 13128 | 10554 | 9509 | 9169 |

Overall, as far as the TDI market is concerned, it can be seen that the proportion of imports from the United States is very small, and it is very important for domestic TDI imports have limited impact, even if China’s import of TDI A> The 10% tariff will have little impact on the TDI market in the short term. However, exports to the United States still account for a certain proportion. Therefore, the United States has imposed tariffs on TDI from China (since September 2018 The tariff rate will be 10% from the 24th, and the tariff rate will be increased to 25% from January 1, 2019), for domestic TDIExport volume will be affected to some extent.

[Postscript] The section “Kanping PU every day” is a high-quality original column carefully created by Tiantian Chemical Network for you. The content includes the review of the polyurethane raw material market, the forecast of the future market, and the dynamics of manufacturers’ equipment, etc. The latest and most dazzling industries Information. thanks for watching! If you have other opinions, please feel free to leave a message, or call the editor to share and exchange the market: 18221824746 (WeChat synchronization: Miss Lin)!

Export weight

13128

10554

9509

9169

Overall, as far as the TDI market is concerned, it can be seen that the proportion of imports from the United States is very small, and it is very important for domestic TDI imports have limited impact, even if China’s import of TDI A> The 10% tariff will have little impact on the TDI market in the short term. However, exports to the United States still account for a certain proportion. Therefore, the United States has imposed tariffs on TDI from China (since September 2018 The tariff rate will be 10% from the 24th, and the tariff rate will be increased to 25% from January 1, 2019), for domestic TDIExport volume will be affected to some extent.

[Postscript] The section “Kanping PU every day” is a high-quality original column carefully created by Tiantian Chemical Network for you. The content includes the review of the polyurethane raw material market, the forecast of the future market, and the dynamics of manufacturers’ equipment, etc. The latest and most dazzling industries Information. thanks for watching! If you have other opinions, please feel free to leave a message, or call the editor to share and exchange the market: 18221824746 (WeChat synchronization: Miss Lin)!

微信扫一扫打赏

微信扫一扫打赏