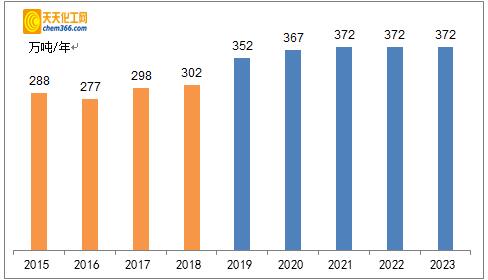

In 2018, the total global production capacity of TDI was 3.02 million tons, and the total global production capacity in 2023 will be It will reach 3.72 million tons, an increase of 23% compared with 2018. So far, the total production capacity in Asia will account for 60% of the global total production capacity.

Figure 1 2014-2022 global capacity change trend map

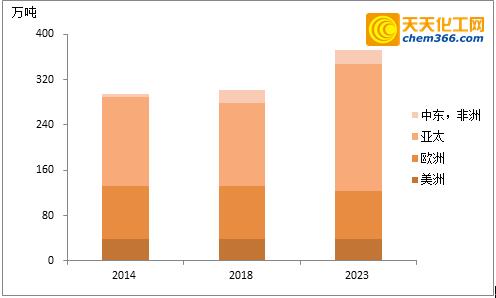

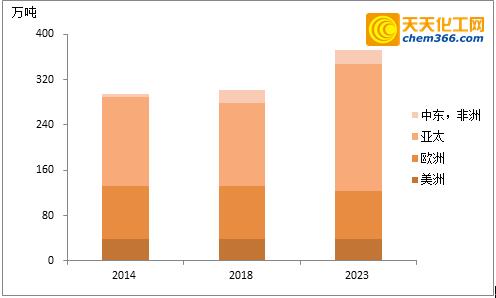

Table 1 Regional distribution of global TDI production capacity from 2014 to 2023 (unit: 10,000 tons)

the

| 2014 | 2018 | 2023 |

America | 38.8 | 38.8 | 38.8 |

Europe | 93.1 | 93.0 | 85.0 |

Asia Pacific | 158.2 | 146.2 | 224.2 |

Middle East, Africa | 4.0 | 24.0 | 24.0 |

total | 158.2 | 146.2 | 224.2 |

Middle East, Africa | 4.0 | 24.0 | 24.0 |

total | 294.1 | 302.0 | 372.0 |

Chart 2 2014-2023 TDIproduction capacity change trend chart

Specific to the continents, there are basically no new construction plans in North America. TDI production capacity integration and expansion in Europe has basically entered the final stage, and the total production capacity has not changed much.

For the Middle East and Africa region, with Saudi Sadara’s 200,000-ton plant put into production, plus Iran’s original Karoon’s 40,000-ton/year TDI plant, the total production capacity of this region is 240,000 tons per year, accounting for nearly 8% of the global production capacity. The Middle East and Africa are also gradually moving towards TDI capacity self-sufficiency. In the future, Chinese, Korean, Japanese, European and American manufacturers will export TDI There will be more competition in this area.

Asian region, South Korea, Japan TDI has no capacity expansion or new construction plan in recent years Announced that the main capacity increase still comes from China. According to the current progress of new plant construction and the announced new construction and expansion plans, in the next three years, China’s TDI production capacity will increase significantly In 2019 alone, with the official production of Wanhua and the commissioning of Xinjiang Heshan Juli, China’s total production capacity will reach 1.47 million tons per year, accounting for 41% of the world’s total. China and the world will enter a stage of overcapacity. As a result, the price of TDI may run close to the cost line, which may force some small and medium-sized TDI factories, China’s TDI industry will also undergo a centralized reshuffle, after which TDI production will become more and more concentrated. In order to cope with the fierce competition in the future, TDI manufacturers are currently or have introduced plans to expand production capacity, improve scale effect, or merge with polyether factories Or team up and prepare for fierce competition in the years ahead.

For more in-depth analysis of this year’s TDI market, please pay attention to 《2018 Annual Report》launched by Tiantian Chemical Network China TDI Market Research Report”!

294.1

302.0

372.0

Chart 2 2014-2023 TDIproduction capacity change trend chart

Specific to the continents, there are basically no new construction plans in North America. TDI production capacity integration and expansion in Europe has basically entered the final stage, and the total production capacity has not changed much.

For the Middle East and Africa region, with Saudi Sadara’s 200,000-ton plant put into production, plus Iran’s original Karoon’s 40,000-ton/year TDI plant, the total production capacity of this region is 240,000 tons per year, accounting for nearly 8% of the global production capacity. The Middle East and Africa are also gradually moving towards TDI capacity self-sufficiency. In the future, Chinese, Korean, Japanese, European and American manufacturers will export TDI There will be more competition in this area.

Asian region, South Korea, Japan TDI has no capacity expansion or new construction plan in recent years Announced that the main capacity increase still comes from China. According to the current progress of new plant construction and the announced new construction and expansion plans, in the next three years, China’s TDI production capacity will increase significantly In 2019 alone, with the official production of Wanhua and the commissioning of Xinjiang Heshan Juli, China’s total production capacity will reach 1.47 million tons per year, accounting for 41% of the world’s total. China and the world will enter a stage of overcapacity. As a result, the price of TDI may run close to the cost line, which may force some small and medium-sized TDI factories, China’s TDI industry will also undergo a centralized reshuffle, after which TDI production will become more and more concentrated. In order to cope with the fierce competition in the future, TDI manufacturers are currently or have introduced plans to expand production capacity, improve scale effect, or merge with polyether factories Or team up and prepare for fierce competition in the years ahead.

For more in-depth analysis of this year’s TDI market, please pay attention to 《2018 Annual Report》launched by Tiantian Chemical Network China TDI Market Research Report”!

微信扫一扫打赏

微信扫一扫打赏