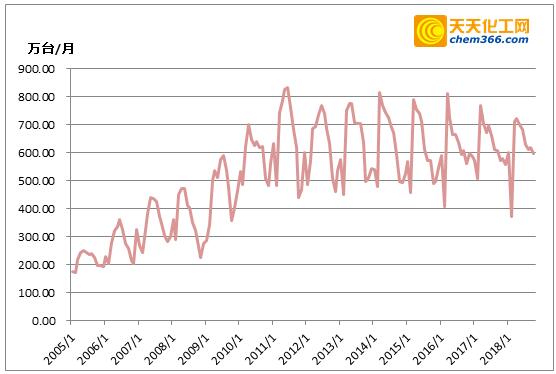

As shown in the figure below, the output of my country’s refrigerator industry reached its peak in 2011, and then operated weakly in 2012-2018. Judging from the data, the annual production of refrigerators in 2010 was 70.55 million units; it surged to 78.82 million units in 2011, and fluctuated between 73 million and 76.5 million units in 2012-17.

Figure 2005-2018 Production of household refrigerators in China

In 2018, the overall growth of the refrigerator industry was sluggish. According to industry online statistics, the total output of the refrigerator industry from January to September 2018 was 62.51 million units, a year-on-year decrease of 2%. , the overall market presents the following characteristics.

Hot outside and cold inside: According to industry online data, from January to October 2018, domestic sales of refrigerators were 36.259 million units, a year-on-year decrease of 4.9%; exports were 26.523 million units, a slight increase of 1.85% year-on-year %. Domestic sales still account for nearly 60% of the overall market share of refrigerators, which has been declining continuously since 2014. The main reason is that the market is gradually becoming saturated, and new demand has replaced new demand as the main driving force for market support. In terms of exports, with the recovery of the global economy, the economic growth momentum of developed economies is good, the growth rate of emerging markets and developing economies has stabilized and picked up, and the global refrigerator market has entered a stage of steady development, so exports continue to grow. However, the growth of demand in some regions of the world has not been as expected and the supply in other countries has increased. At the same time, affected by uncertain factors such as trade wars, refrigerator exports will also face a lot of pressure in the future.

The market concentration continues to strengthen:In the first nine months of 2018, the domestic market concentration of TOP5 companies has increased to 67%, an increase of 4.2% compared to the same period last year. It can be seen that although the overall development of the industry is not good, compared with small and medium-sized enterprises, the situation of large enterprises is much better. Even in the fierce competition, some enterprises have shown an increase in market share.

High-end:CMM’s offline monthly monitoring data show that in 2017, the retail sales of the overall refrigerator market fell sharply by 11.4%, and the high-end refrigerator market above 8,000 yuan bucked the trend Rising, or as high as 26.5%. Although the growth rate in 2018 slowed down on a higher base, it still maintained a growth rate of more than 20%, with a share of 9.1%.

Opinion from Tiantian Chemical Network: In terms of domestic sales, as early as the end of 2016, the average number of refrigerators per 100 households in the country has reached 93.5, and the household ownership of refrigerators has approached saturation. Generally, the replacement cycle of refrigerators is long. At the same time, the property market is cold, and there is less new consumer demand. Therefore, the main growth point in the future will still be product upgrading. High-end refrigerators are expected to maintain a relatively high growth rate in recent years. In terms of exports, more attention should be paid to the impact of uncertain factors such as the Sino-US trade war.

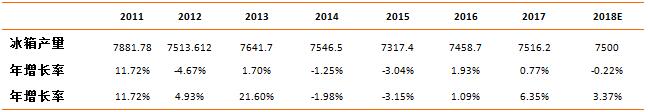

Table 2010-2018 China household refrigerator production statistics (unit : ten thousand units, ten thousand tons)

Table 2010-2018 China household refrigerator production statistics (unit : ten thousand units, ten thousand tons)

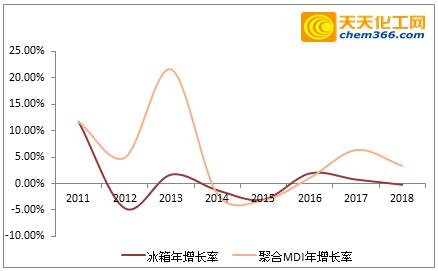

Figure 2011-2018 China household refrigerator production growth and polymeric MDI consumption growth comparison chart (unit: percentage)

From the above figure, we can see that the annual growth rate of domestic polymeric MDI is basically consistent with the trend of refrigerator production. As the largest aggregate MDI consumer market in my country, the freezer industry is interested in aggregation The influence of MDI is self-evident.

微信扫一扫打赏

微信扫一扫打赏