Toluene diisocyanate (TDI) is an important organic chemical raw material. TDI is mainly used in soft foam, coating, elastomer and adhesive. Among them, flexible foam is the largest consumption area, followed by coatings, and the two together account for nearly 90%. Flexible polyurethane foams are used in a wide range of applications in the furniture, construction and transport sectors. In addition, TDI can also be used in the production of adhesives, sealants, nylon-6 crosslinking agents, polyurethane coatings and polyurethane elastomer intermediates.

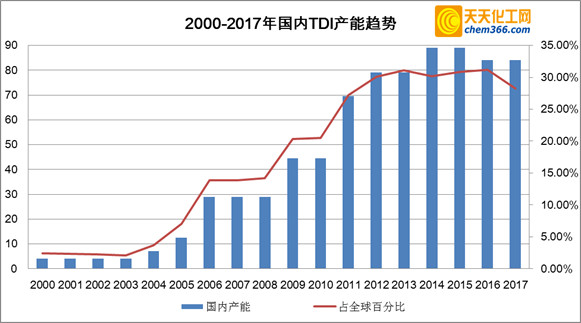

TDIThe production technology is complex and the requirements for process equipment are high. Only a few companies such as BASF, COVESTRO, DOW, and Mitsui have intellectual property rights. Mastery, production is relatively concentrated, with the rise of the Asian economy, Asia-Pacific TDI production capacity in the global TDI is gradually increasing, and manufacturers in the Asia-Pacific region are mainly concentrated in China, Japan and South Korea. China is the most important TDI consumer country is also the country with the most TDI manufacturers and the largest total production capacity in the world, accounting for nearly 28% of the global production capacity about. From 2000 to 2017, the compound growth rate of TDI production capacity in China was as high as 19.6%.

Before 2003, domestic TDI only had 2 sets of small equipment, and there were still some technical problems, and they were still in the stage of exploration. The yield is lower.

In 2004, domestic production capacity of TDI began to increase significantly. It can be seen from the change trend of TDI production capacity in the above figure from 2000 to 2017 that China’s production capacity made a qualitative leap in 2006, 2009 and 2011 respectively. Mainly due to BASF (160,000 tons TDI plant in 2006), Covestro (250,000 tons TDI device) the opening of two sets of world-scale equipment, plus the commissioning of three domestically produced 50,000-ton devices.

Before 2011, China’s TDI production capacity was smaller than domestic demand, and imports were needed to make up for the domestic demand gap. With Covestro Shanghai TDI plant successfully put into operation in 2011, China’s TDIThe self-sufficiency capacity has increased significantly. In 2012, Canghua and Juli expanded their production one after another, and China began to become a country with more exports than imports.

In 2013, there was no new TDI production capacity in China. At the end of 2013, Fujian Petrochemical’s new plant was put into operation, and its new production capacity was 100,000 tons, but In most of 2014, the single-line production of 50,000 tons was maintained.

Liaoning Jinhua operated intermittently for about 5 months in 2015, and did not restart after stopping in July. In September 2016, Liaoning Jinhua declared bankruptcy.

In 2016-2017, there was no new TDI production capacity in China, coupled with the impact of the shutdown of some foreign devices, domestic and global in 2016-2017 class=link href=”/TDI/” target=_blank>TDIThe price has started to rebound due to the reduction of supply.

In 2018, the domestic TDI market was surging, and domestic and foreign TDI Expansion of production and new construction are concentrated. For more details, please refer to the 2018 China TDI market report provided by Suntower Consulting !

微信扫一扫打赏

微信扫一扫打赏