Refrigerator Freezer Industry2021Operation in the first quarter of the year

Refrigerator:According to the data of Aowei Cloud,In the first quarter of 2021the retail sales of refrigerators in China will be 674 10,000 units, a year-on-year increase43.9%, compared to2019Growth in the first quarter of 201911.4%; market The retail sales are209100 million yuan, a year-on-year increase60.8%, compared to2019Year-on-year growth15.8%. In terms of channels, the online and offline retail sales of refrigerators in China in the first quarter of this year were 424Wantaihe24910,000 units, year-on-year growth respectively50.9%andand33.2%, compared to2019Respective growth in the same period of the year57.0%and drop25.7 %. The online and offline retail sales are 95%95billion respectively and 114100 million yuan, a year-on-year increase69.6%and54.1%, compared to2019Year-on-year growth respectively69.6%and drop8.8%. The online refrigerator market grew faster than the offline refrigerator market, compared to2019The first quarter of 2019 also maintained a high growth rate.

Freezer:According to AVC data,2021The retail volume of China’s refrigerator market in the first quarter of 2019 was 265.710,000 units, a year-on-year increase85.8%, compared to2019Growth in the first quarter of 201935.8%; market retail sales are31.8100 million yuan, a year-on-year increase94.1%, compared to<spanThe chain is difficult to recover in a short period of time, and the export market of refrigerators and freezers is expected to continue high growth. Looking forward to the next five years, the market for refrigerators and freezers will see both advantages and challenges.

Refrigerator industry: 1) continues to develop in the direction of multi-door, but the demand for super-large volume products is significantly reduced. Cross and side-by-side door products will still be the main driving force for the growth of the refrigerator industry, accounting for a total of 55.8%. However, with the gradual popularization of the new crown vaccine, residents’ demand for food hoarding has weakened, coupled with the convenience of fresh food e-commerce, the market space for super-large-volume products has narrowed. 2) The demand for health dimensions is increasing day by day. After experiencing the epidemic, consumers’ awareness of health protection has been further enhanced, and health consumption has been upgraded. Refrigerators equipped with functions such as sterilization, freshness preservation, and deodorization continue to It has been promoted, and there are corresponding solutions for various storage scenarios such as dry and wet, raw and cooked, soft frozen, red wine, mother and baby, and medical beauty. 3) Toward high-end development. High-end refrigerator products have grown significantly. According to the data from the National Household Appliance Industry Information Center,In 2020The retail volume share of high-end refrigerator products in 2020 from2019year31.4%Improve to52.3%. In the future, as the epidemic gradually passes, domestic refrigerators will return to the demand for replacement. The improvement basically depends on the optimization of the product structure. Overall, the refrigerator industry is expected to maintain steady growth in the future.

Refrigerator industry:On the one hand, with After 90,00The post-consumer group has gradually become the main force of consumption, and consumer demand for enjoyment and health is increasingly favored by consumers. The proportion of emerging categories such as ice bars and vertical freezers continues to increase, increasing the imagination of freezers; At the same time, there is a large demand for COVID-19 vaccines around the world, and the refrigeration storage requirements for vaccines will also drive the rapid development of vaccine freezers. On the other hand, emerging brands in the freezer market have emerged to seize the market with low prices, and fierce competition in the online market and the fourth- and fifth-tier markets has lowered the average price of the industry; The freezer market has a certain squeeze effect. All in all, there is still a lot of room for growth in the refrigerator industry in the future.

In the future, the refrigerator freezer industry will still be the main growth point of polyurethane rigid foam

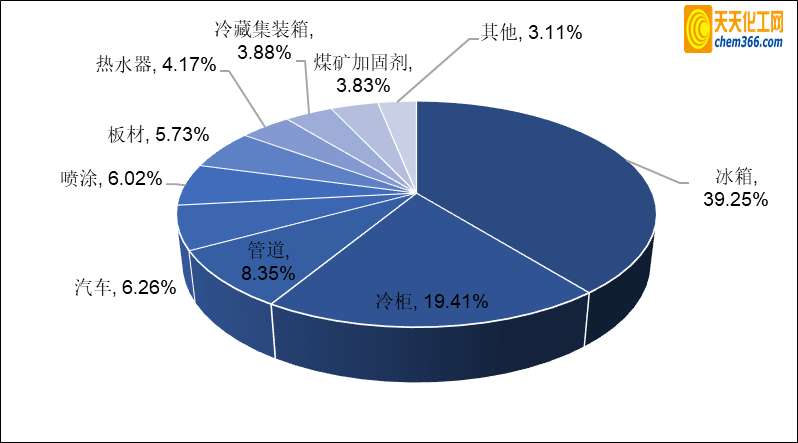

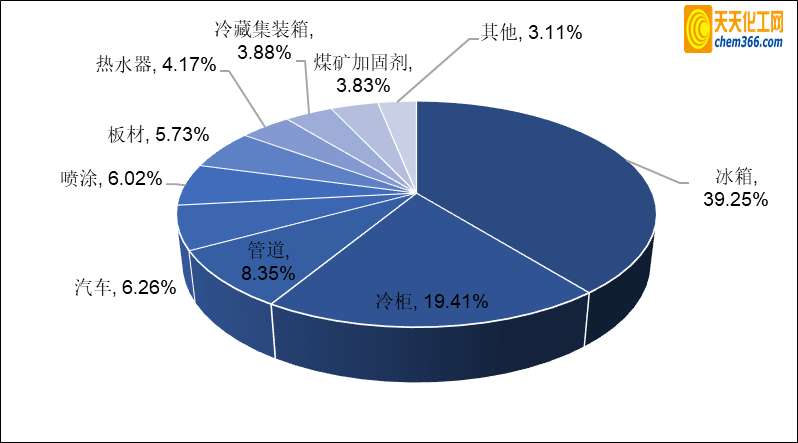

According to Tiantian Chemical Internet research, 2020China’s polyurethane rigid foam production is206.110,000 tons, distributed in refrigerators, freezers, pipelines, automobiles , spraying, plates, water heaters, refrigerated containers, coal mine reinforcement and other industries. Among them, rigid polyurethane foam accounts for the largest proportion in the refrigerator industry, accounting for 39.25% of the total output of rigid polyurethane foam; followed by the refrigerator industry, accounting for 19.41%. As the refrigerator freezer industry maintains rapid growth in the future, the refrigerator freezer industry will still be the main growth point of polyurethane rigid foam.

Figure1 2020Proportion of Polyurethane Rigid Foam in Various Downstream Application Fields

Figure1 2020Proportion of Polyurethane Rigid Foam in Various Downstream Application Fields

微信扫一扫打赏

微信扫一扫打赏