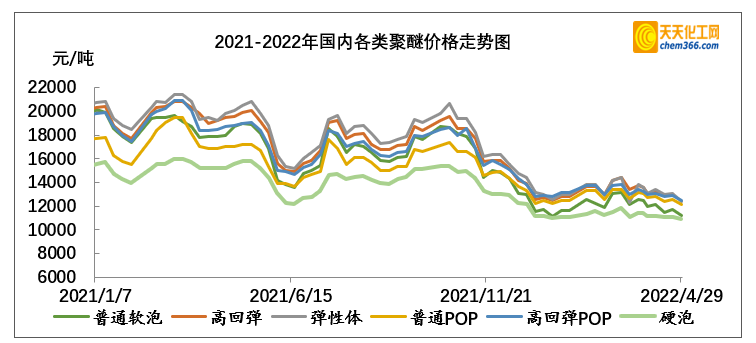

Polyether Market Review

The polyether market fluctuated in a range in April. The overall polyether inquiry price before and after the Ching Ming Festival has improved compared with the previous period, especially on the first day after the festival, the raw material cyclopropane has achieved more obvious results, the main downstream inventories have been exhausted, and the replenishment of just-needed goods is relatively concentrated, and the orders of polyether factories are higher than expected . Affected by the epidemic in the middle of the month, although the production of automobiles and related industrial chains that were suspended due to the impact of the epidemic began to promote orderly resumption of work and production, the effect of boosting raw materials was still not good. The enthusiasm of factories to purchase was far lower than expected, and the market still needed a long period of time to repair and develop. . On May 6, the China Association of Automobile Manufacturers calculated based on the data of key enterprises that in April 2022, the sales volume of the automobile industry is expected to complete 1.171 million vehicles, a month-on-month decrease of 47.6% and a year-on-year decrease of 48.1%; from January to April 2022, the sales volume is expected to complete 7.68 million units Affected by the epidemic and the downturn in the stock market, the traditional peak season of “Xiaoyangchun” in the national property market It did not appear that the building materials market continued to weaken, and the sponge factory continued to operate. At a low level, the speed of rigid demand consumption also slowed down. Downstream industries of hard foam, such as home appliances, panels, styrofoam and containers, generally have a significant decline in demand for raw materials month-on-month/year-on-year; many insulation engineering projects in the north continue to be shut down due to poor supply of upstream raw materials and epidemic control. Although the epidemic in April triggered an upsurge in food hoarding in cities such as Beijing, Shanghai, Guangzhou, and led to an increase in the purchase and consumption of freezers and display cabinets, some areas with severe epidemics even saw the phenomenon of group-buying freezers; However, it is difficult to alleviate the impact of the epidemic as a whole. Dexin Federal is undergoing short-term maintenance, and the overall market volume is abundant, and some major manufacturers have successively negotiated for low prices. Towards the end of the month, the price reduction of cyclopropane has had little effect. With the support of numerous orders, polyether has been dragged down one after another. Coupled with the lack of work on the demand side and the obstruction of transportation, the industry has insufficient confidence in the market outlook.

polyether market outlook

Raw material end: Jishen overhaul for about 20 days, Dagu may produce products in late May (the first phase of Tianjin Bohua’s “Two Chemicals” relocation project includes 600,000 tons/year caustic soda plant, 800,000 tons /year vinyl chloride plant, 800,000 tons/year polyvinyl chloride plant, 100,000 tons/year hydrogen peroxide plant, 300,000 tons/year polypropylene plant, 200,000 tons/year propylene oxide co-production of 450,000 tons/year styrene Equipment, 1.8 million tons/year methanol-to-olefins unit.In April, the 100,000-ton hydrogen peroxide construction general contracting project was successfully trial-produced, and hydrogen peroxide with a qualified concentration was produced. The last methanol-to-olefins unit after Labor Day in May The official commissioning and commissioning of the trial run has begun, which also marks that the first phase of the project has reached its full capacity, officially entering the 30-day sprint countdown, and the 20/450,000 tons PO/SM plant will be put into production soon)The operating rate of the cyclopropane market is around 70%, and the inventory of manufacturers remains at a medium to high level.

Supply side: Polyether plants maintain an overall operating rate of 60%, with sufficient inventory.

Demand side: The current domestic epidemic situation is still severe. Although some areas have begun to resume work and production in an orderly manner, domestic sporadic cases are emerging one after another. Local control policies still exist, and it will take some time for logistics, transportation and industrial chains to resume However, there is no sign of improvement in the short-term suppression of demand by the epidemic factor, and the follow-up of terminal demand is weak. If the epidemic situation continues to improve in the future, downstream demand is expected to pick up, but it will still take some time.

On the whole: polyether polyols may continue to be weak in May.

微信扫一扫打赏

微信扫一扫打赏