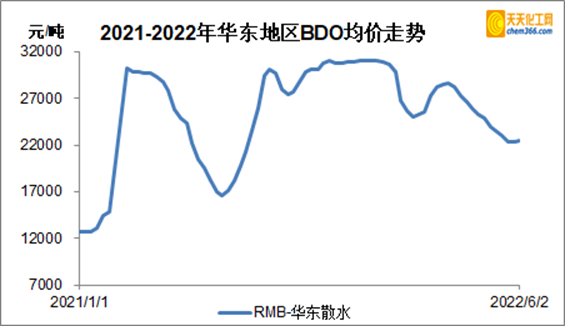

Cost side: Recently, the domestic BDO market has been sorted out within a narrow range. Many facilities have entered into replacement maintenance, and Markor, the United States and Europe have recently undergone maintenance, and the supply-side support is good. Due to the high inventory, the operating rate of the main downstream spandex industry has decreased, and there is stockpiling, so the demand for BDO purchases is not ideal. The start-up load of the PBT industry has rebounded slightly, but the downstream demand is weak, so the impact on the BDO price is not obvious. However, the BDO market has been falling for three consecutive months. With the end of the epidemic, manufacturers have a strong willingness to support the market. BDO prices have rebounded recently, so the cost side is slightly positive for THF. As of June 2, the mainstream price of BDO in East China is 22,300-22,700 yuan/ton for reference, and the bulk water will be accepted and delivered.

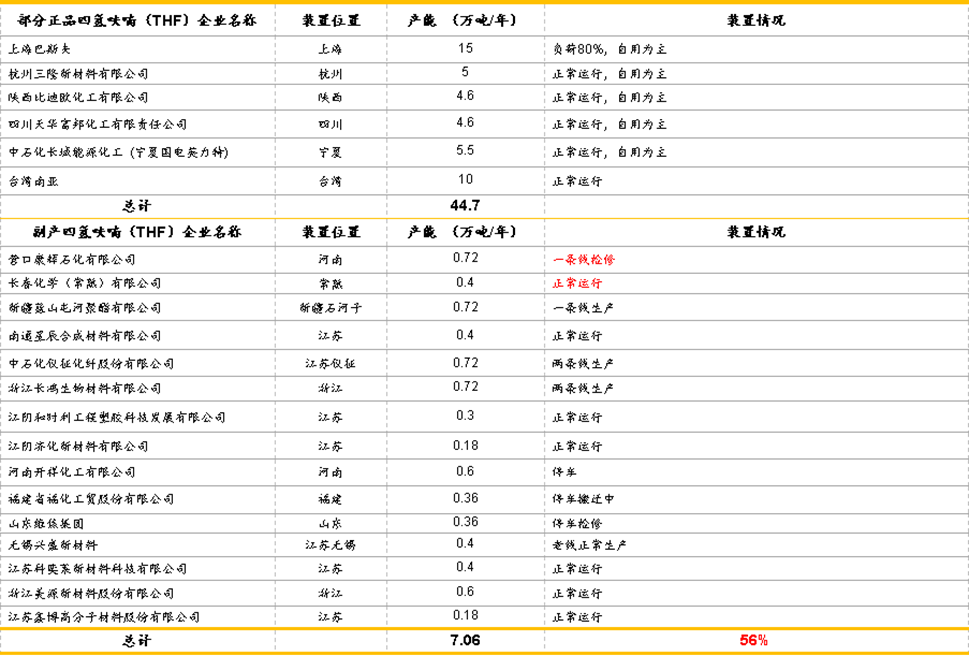

Supply side: UpstreamRecently, although the start-up load of the PBT industry has increased, the increase has not been as good as in the past few weeks, so the THF output of the resumption of production has declined. However, due to the large increase in the previous period, the THF spot supply for the resumption of production is still sufficient, so the support on the supply side is still weak. As of June 2, the price reference for the acceptance and delivery of by-product bulk water is 31,500-34,000 yuan / ton, the price of barrel delivery is 32500-35000 yuan / ton.

Demand side: Although the overall spandex industry started relatively high in May, as the middle and lower reaches of the spandex demand side continued to weaken, the inventory remained high, and the spandex supply side dropped to 80%, the pressure on suppliers’ production and sales is obvious, the competition within the industry is fierce, and the weekly decline is enlarged. Among them, the decline of 20D is mostly 3-4 thousand, the decline of 30D is slightly smaller at 1-2 thousand, and the decline of 40D is adjusted by 1 thousand. To sum up, the main spandex demand is currently continuing to decline. In addition, other downstream demand is still weak due to the sequelae of the epidemic, and live ammunition trading is limited. The lack of demand and the increase in supply have caused THF market prices to plummet in recent weeks.

Market forecast: Overall, due to the long backlog of the main downstream spandex industry, the operating rate has dropped sharply, and the cost sideBDOand the supply sidePBTThe positive trend of the industry is not obvious. Even if the increase in demand brought about by the unblocking of Shanghai is only a drop in the bucket. It is expected to wait until 7 in July when Shanghai unblocks for a month and the demand is normal and the inventory of the spandex industry is clearedTHFPrices will improve.

微信扫一扫打赏

微信扫一扫打赏