According to the “Import and Export Trends in January” released by the Ministry of Industry, Trade and Energy of South Korea on February 1, South Korea’s exports in January decreased by 16.6% year-on-year to US$46.27 billion, the first consecutive year since the beginning of 2020. There was a year-on-year decline in four months, and it is expected to only fall by 11.1%; imports fell by 2.6% year-on-year to US$58.96 billion, unchanged from expectations; the trade deficit in January widened to US$12.69 billion, a record high in a single month. This is the first time in 25 years that South Korea has experienced a trade deficit for 11 consecutive months since January 1995 to May 1997.

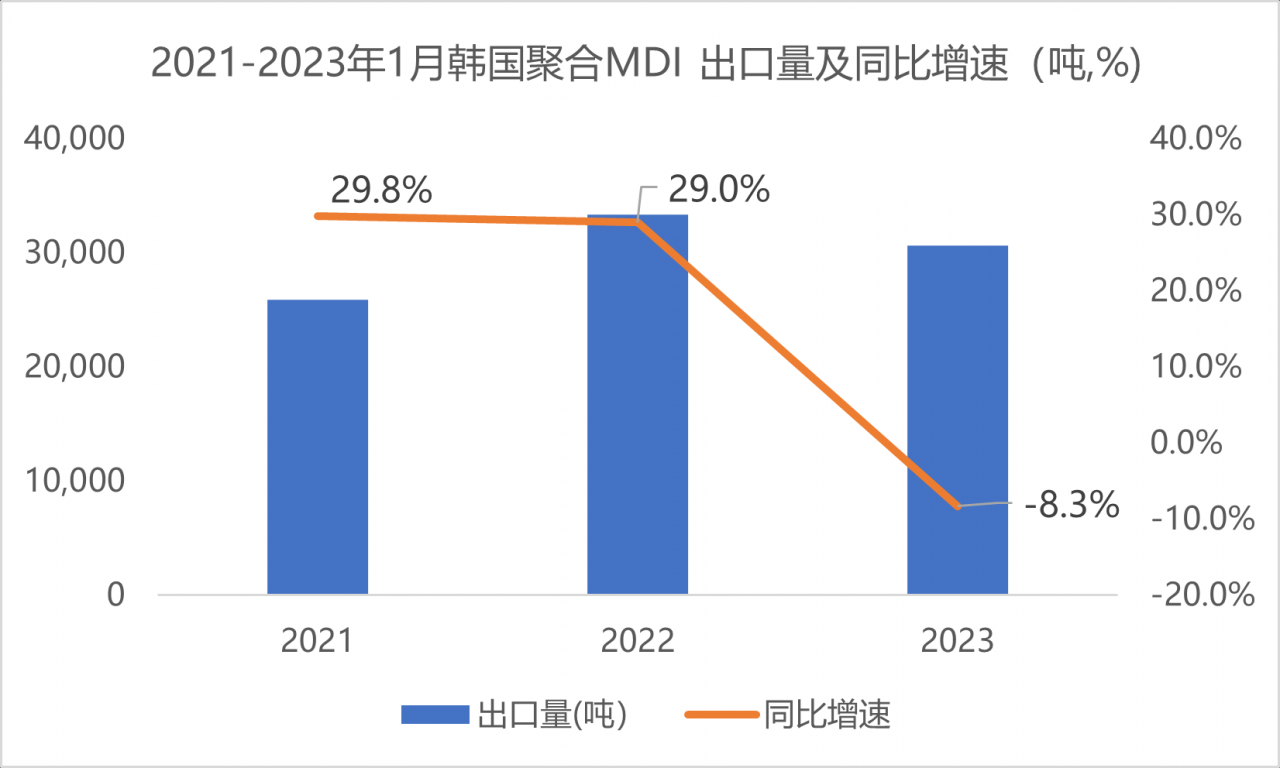

Data source: customs data collation

In 2023, South Korea’s export volume of polymeric MDI was only 30,620 tons, a year-on-year decrease of 8.3%. Mainly due to the decrease in downstream demand.

Affected by the slowdown in global economic growth, South Korea’s main export semiconductor industry has been hit hard. According to reports, the global shortage of automotive chips that has lasted for nearly a year is still ongoing, and its impact on related manufacturers is also continuing, resulting in a significant decline in their production and sales. In January, South Korea exported 179,700 vehicles. South Korea’s auto exports have declined, in addition to the shortage of self-produced chips, but also because his competitors are growing rapidly, mainly in China and Japan in Asia. Japan has a wide range of models and complete systems, and the design of Japanese cars is based on the principle of fuel efficiency and durability. Therefore, in the era of rising international oil prices, Japanese cars have made great achievements, and they have always been the world’s number one car exporter. At the same time, China also accounted for a considerable share of the market. In 2022, China’s auto exports will be 3.11 million, a year-on-year increase of 54.4%, second only to Japan’s 3.5 million. The Korea Automobile Manufacturers Association stated on January 25 this year that “the rapid growth of China’s auto exports has had a negative impact on the expansion of South Korea’s exports.” Even if the chip crisis is eased in 2023, South Korea’s auto exports and production will hardly increase improvement.

In addition, in South Korea, refrigerators & freezers, one of the important downstream of polyurethane, fell by 63.2% year-on-year, and furniture fell by 21.4% year-on-year. In the case of reduced exports in all aspects, South Korea’s imports did not decrease. The total import volume in January reached US$58.96 billion, of which imported energy was US$15.8 billion, accounting for 26.8% of total imports, which was much higher than the average January energy import value of US$10.3 billion from 2013 to 2022. Previously, South Korea was caught in the problems of currency depreciation, high inflation, and corporate defaults. If the trade deficit continues this year, it will be even worse for the South Korean economy. In addition, the trade deficit will further reduce South Korea’s foreign exchange reserves. Insufficient foreign exchange reserves will further increase South Korea’s external vulnerability.

To sum up, domestic demand in South Korea remains strong, but such a high trade deficit is bound to have a negative impact on South Korea, and overseas demand for South Korean polyurethane downstream products continues to be weak , in order to help boost exports, the South Korean government needs to use all available policies and resources to boost exports.

微信扫一扫打赏

微信扫一扫打赏