With the return of the Spring Festival holiday, the prices of various domestic chemical raw materials have started to rise in spring. For pure MDI, this wave of market started earlier. Since December last year, with the increase in the production load of downstream manufacturers, the consumption capacity of raw materials and the increase in demand for goods, this directly led to a rebound in the low price of pure MDI market. In January, some pure MDI manufacturers controlled the quantity of supply, and with the successive suspension of logistics during the Spring Festival, although the on-site spot negotiations and transactions gradually decreased, the pure MDI market price still maintained a unilateral upward trend during the month.

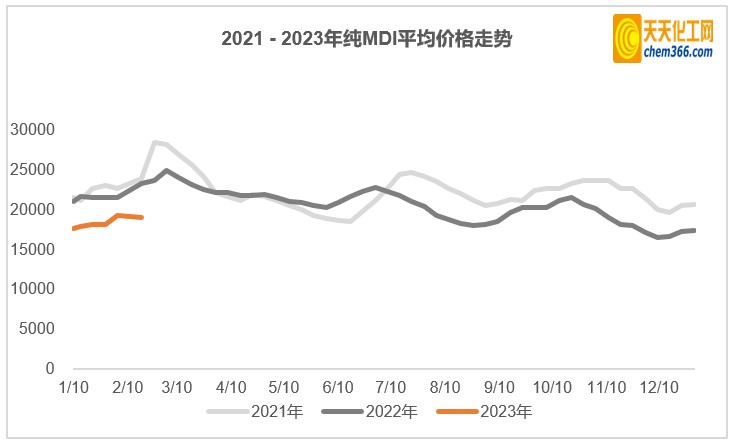

2In the first ten days of this month, domestic pure MDI continued to rise. By February 7, the market price rose to 19,300-19,500 yuan/ton. In the past week, the market has digested and sorted out, the mentality of the industry has diverged, and the panic of profit selling has increased, which has driven the price range to fluctuate, and high and low quotations have been heard on the market.

The current market is in shock, will the spring market continue? What is the market outlook for pure MDI?

Supply side: Chongqing and Ningbo plants have been shut down for maintenance this month, and the corresponding parked production capacity accounts for the largest domestic 27% of the total production capacity. In addition, since the Ningbo overhaul time is later than in previous years, the recent year-on-year supply shrinkage is more obvious.

Demand side: The main downstream industries of pure MDI are TPU elastomer, spandex, sole liquid and slurry. According to statistics, the current effective operating rate of the domestic spandex industry has increased to more than 80%, and some factories are nearly at full capacity; the operating rate of the TPU industry is 60-70%, due to the improvement in demand for end products such as pneumatic tubes, and some major TPU manufacturers are open during the Spring Festival , and the start-up load remains high; relatively speaking, the start-up load of the shoe sole liquid and slurry industry is still running at a low level, and orders from downstream terminals have not yet picked up significantly. In March, with the advent of the traditional peak production season, the overall production and sales of the shoe sole solution and slurry industry are expected to pick up.

As can be seen from the above figure, although domestic and Japanese and Korean manufacturers have raised the guidance price of the Chinese market in February, the current pure MDI The market price is still at the low level of the same period in the last two years. As the output of the supply side continues to decrease in the near future, and the demand side is expected to be better, the gap between supply and demand is expected to gradually narrow, which will drive the pure MDI market to consolidate in the future.

微信扫一扫打赏

微信扫一扫打赏