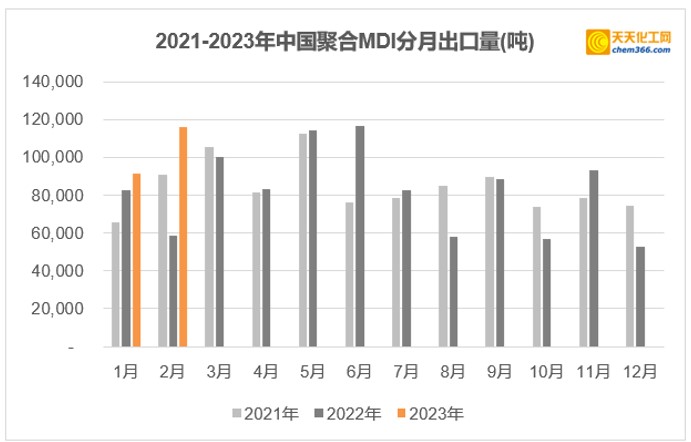

According to the latest data released by China Customs , From January to February 2023, China’s cumulative export volume of polymeric MDI was 207,700 tons, a year-on-year increase of 46.9%.

Figure: 2021-2023 China Polymerized MDI monthly export volume (unit: tons)

to Europe/Middle East Country’s Export Volume Growth Strong

In terms of countries, 1- In February, the United States was still the largest export destination of China’s polymeric MDI (according to export volume). The polymeric MDI exported to the United States was 47,338 tons, a year-on-year increase of 21.5%. The export volume of polymeric MDI from China to the United States accounted for 13.4% of the total export volume. . It is worth mentioning that during the same period, the export volume of polymeric MDI from China to the Netherlands, Turkey and the Russian Federation grew stronger year-on-year. The export volume of aggregated MDI from China to the Netherlands increased by 101% year-on-year, the export volume to Turkey increased by 329% year-on-year, and the export volume to the Russian Federation increased by 283% year-on-year.

Table: China’s top ten export destinations, export volume and year-on-year growth rate of polymeric MDI from January to February 2023

Production maintenance of some MDI devices in Europe/ Shut down, or reduce the burden and reduce production, so in recent months, the supply of local manufacturers to the European market has decreased. The main reason for the reduction is that energy prices in Europe are still high: according to the financial reports of various companies, energy prices in Europe have eased recently, but the cost of natural gas and public works is still seven to ten times higher than that in North America. This disadvantage will be difficult to reverse in the next few years. And the drop in energy prices has more to do with Europe’s warmer winter and the destruction of industrial demand. The second is that the European demand market has shown a trend of weakness due to high inflation since last year. Although the manufacturer responded that the load reduction is to rebalance the supply and demand in the European market, there is a situation that, in addition to supplying the European local market, the MDI of the European manufacturer will also be supplied to the Middle East market. In recent months, the demand market in the Middle East has been relatively strong.

Therefore, although the current European demand is relatively Weak, but the spot price in the local market is still stable at 2200-2300 euros / ton, and according to the latest reports from European market sources, in April, this price is expected to be stable in the range of 2150-2350 euros / ton.stable operation.

For the Middle East market, the current market mainstream The price remains at 1900-2000 US dollars / ton. Due to the recent delay in delivery by a certain MDI manufacturer in the Middle East, and some manufacturers are stocking up for Ramadan, it is heard that the actual local market price is as high as USD 2,200/ton.

微信扫一扫打赏

微信扫一扫打赏