China’s polymeric MDI market in 2023 is about to go through the “first half”. Here, we briefly review the domestic polymeric MDI market in the first half of this year from the market price in the first half of the year, as well as the performance of imports and exports and major downstream industries. market performance.

Polymer MDI market price:

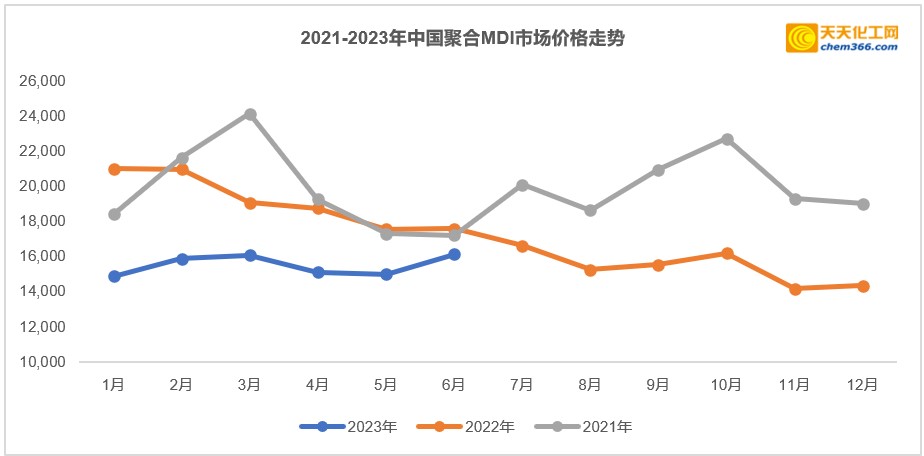

From January to June this year, the domestic polymeric MDI market fluctuated at a low level, and the overall performance was weak. The price range was lower than that of the same period in the previous two years, operating at a low level of 14,000-16,500 yuan/ton. The average market price in the first half of the year was about 15,494 yuan/ton, compared with 19,141 yuan/ton in the same period last year, a decrease of 19.1%.

In the first quarter, the market rose first and then pulled back. Before and after the Spring Festival holiday, out of anticipation of the recovery of the domestic economy and downstream demand, market operators superimposed the overhaul of the Ningbo and Chongqing plants on the supply side in February, and the factory controlled the supply to the market. The market fluctuated upwards from 14,500-15,000 yuan/ton in January 16,000-16,500 yuan/ton until mid-March. However, the recovery of downstream demand was not as good as expected, and the market pulled back after mid-March.

In the second quarter, from April to May, the market fluctuated in a weak range of 14,500-15,500 yuan/ton. In June, multiple sets of equipment in Shanghai were overhauled intensively, and the market was supported upward again. As of the end of June, the market price range was around 16,000 yuan/ton.

As can be seen from the figure below, in the second half of last year, the market fluctuated weakly and fell. Although the overall operating range in the first half of this year was lower than the level of the same period of the previous two years, the trend turned upwards.

In the first half of this year, the good export operation is one of the main supports for the market to reverse its trend and the upward trend.

Aggregate MDI export:

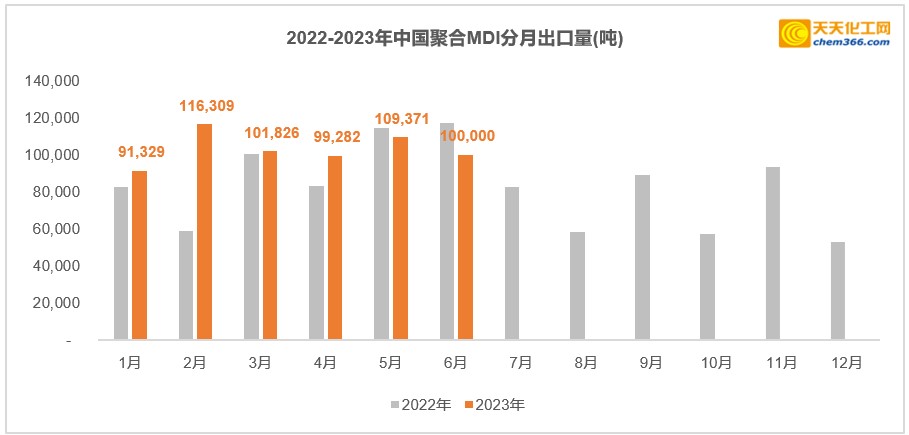

According to China Customs data, from January to May this year, China’s polymeric MDI export volume was 518,100 tons, an increase of 18.0% year-on-year; except for January, the rest of the month was stable at about 100,000 tons/month. It is estimated that in the first half of this year, the year-on-year growth rate of China’s polymeric MDI export volume may be around 11%. However, with the overhaul of overseas devices in the third quarter and the capacity filling of some load-reducing devices in Europe and the United States, it is expected that the export volume will still increase steadily.

Although the cumulative export volume of China’s polymeric MDI in the first five months has achieved double-digit growth, the average export price in each month has shown a year-on-year decline, and the decline in May has expanded. The decline in overseas export prices was mainly affected by the overall weak domestic market prices during the same period.

China’s polymeric MDI export volume and export unit price from January to May 2023

In terms of regions, in the first five months, the United States was the largest export destination of China’s polymeric MDI. The cumulative weight of polymeric MDI imported from China reached 116,000 tons, a year-on-year increase of 1.3%. In addition, during the same period, the total weight of polymeric MDI imported from China by countries along the “Belt and Road” was 205,700 tons (accounting for 60.3% of the total), a year-on-year increase of 41.1%. (Countries along the “Belt and Road”: As of January 6, 2023, China has signed more than 200 cooperation documents on the joint construction of the “Belt and Road” with 151 countries and 32 international organizations. Countries along the “Belt and Road” are China’s export One of the important markets for trade.

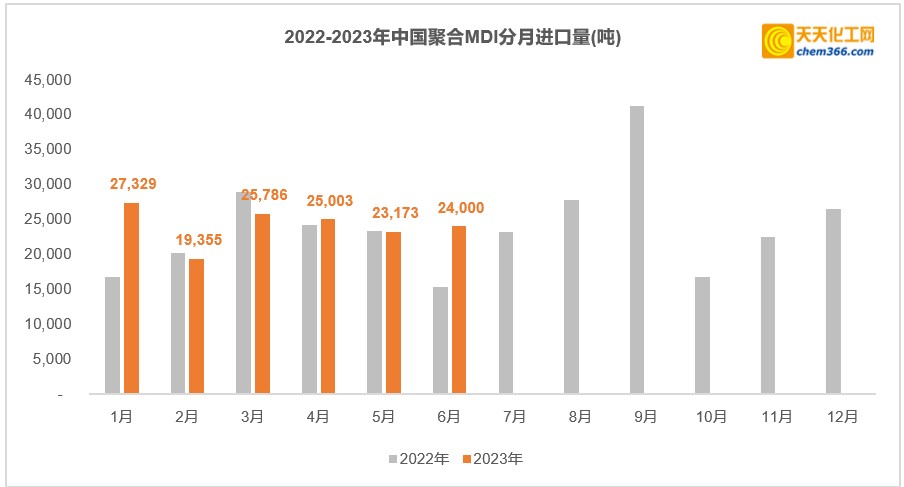

At the same time, the import volume of polymeric MDI also showed a year-on-year increase, which was lower than the increase in export volume.

Aggregated MDI imports:

According to China Customs data, from January to May this year, China’s import volume of polymeric MDI (including MDI mother liquor) was 120,600 tons, a year-on-year increase of 6.7%; except for February, the rest of the months remained at the level of 25,000 tons/month. Polymeric MDI (including MDI mother liquor) imported from Saudi Arabia, Japan and South Korea accounted for 98% of the total. Saudi Arabia is the largest source country. The cumulative import volume in the first five months of this year was 53,000 tons, an increase compared with the same period last year up to 30.0%. Imports from Japan were basically flat year-on-year, while imports from South Korea fell by 10.8% year-on-year. It is estimated that in the first half of this year, the import volume of China’s polymeric MDI (including MDI mother liquor) will increase by about 13% year-on-year.

Requirements:

According to estimates, in the first half of this year, the apparent domestic consumption of polymeric MDI decreased year-on-year. In terms of major downstream industries, refrigerators & freezers: From January to May this year, the output growth rate was about 2.5% year-on-year; the volume of the plate industry increased, and the insulation pipe industry just needed project support to achieve positive growth; relatively speaking, in the first half of the year, domestic refrigerated containers Manufacturers’ orders are not ideal; industries related to real estate such as styrofoam are weak… On the whole, the demand of the main downstream industries has performed better than the decline in apparent consumption. This aspect also reflects that in recent months, the social Inventories are down overall.

微信扫一扫打赏

微信扫一扫打赏