The downstream of propylene oxide terminals are real estate, automobiles, furniture, refrigerators and freezers and other industries, which are closely related to the development of the national economy. The rise of its prosperity will increase the demand for polyurethane and stimulate polyether manufacturers to increase their production capacity. Production intensity, thus increasing the demand for propylene oxide, driving up the price.

5On May 16, according to relevant personnel, Dow Chemical plans to Shut down its propylene oxide unit in Freeport, Texas.

Dow’s reason for shutting down the propylene oxide uniton the one hand is that the unit is close to its service life, on the other hand, it is affected by the slowdown of global economic growth and various force majeure factors , the overall development of the chemical industry is not good. The downstream demand of most terminals tends to be flat, and polyurethane manufacturers have begun to pay more and more attention to segments with higher added value. So the decision to close the unit is part of Dow’s efforts to optimize costs and supply.

Dow Freeport’s propylene oxide unit will continue to operate until the end of 2025, while the downstream polyether polyol unit will continue to operate after the propylene oxide unit is shut down. After 2025, Dow will use resources in other regions or third-party suppliers to supply propylene oxide for the polyol unit. Dow is also investing in logistical capabilities such as propylene oxide storage tanks, pipelines and new barges to keep propylene oxide available.

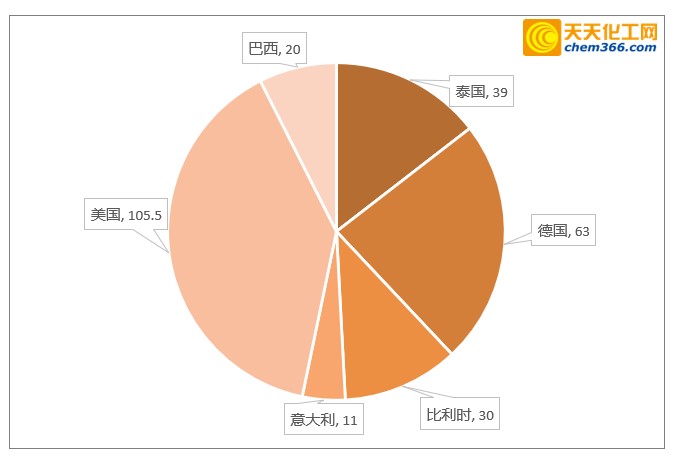

Currently speaking, Dow Chemical is currently the world’s largest manufacturer of propylene oxide, and its installations are widely distributed. There are production facilities in the United States, Germany, Brazil, Belgium and Thailand, with a total production capacity of 2.685 million tons, accounting for 20.24% of the global propylene oxide output value.

Dow Chemical’s Global Propylene Oxide Capacity Distribution(Unit: 10,000 tons)

2018-2022Year Global Ring Propylene oxide production capacity and growth rate (unit: 10,000 tons, %)

Dow propylene oxide uses chlorohydrin technology. The patentees of the chlorohydrin method mainly include DOW of the United States, Asahi Glass of Japan, Mitsui Topress and Showa Denko. The chlorohydrin method was industrialized as early as 1931, and has the advantages of mature technology, short process, low requirements for raw material purity, and low investment. The core of this technology is the chlorohydrinization reactor, and Dow Chemical’s tubular reactor is the representative of the chlorohydrin process.

Chlorohydrin process is seriously polluting the environment. Today, under the background of increasingly strict environmental protection supervision, the use of chlorohydrin process technology is facing great challenges. The United States has already eliminated it in 2000 Chlorohydrin method technology, my country also listed the chlorohydrin method PO process as a restricted item in the “Industrial Structure Adjustment Guidance Catalog (2011)”, and new equipment cannot use the chlorohydrin method process.

The supply gap caused by the closure of Dow’s propylene oxide plant in the United States will be partially supplemented by LyondellBasell (In March this year, LyondellBasell announced that it had successfully started the world’s largest propylene oxide (PO) and tertiary butanol (TBA) plant in Texas. These new plants located on the Gulf Coast of the United States can produce 47 10,000 tons of PO and 1 million tons of TBA and its derivatives.); part of South Korea, Saudi Arabia Asia, Thailand and other Asian sources of propylene oxide will also increase their exports to the United States. China’s propylene oxide is subject to technological requirements and no export tax rebates, and its export share is very small. Propylene oxide downstream products polyether polyol, propylene glycol, and propylene glycol The ether tax rebate rate was raised to 13%, further enhancing its export competitiveness.

微信扫一扫打赏

微信扫一扫打赏